Tag Archive 'Economics'

Bring Back Welfare, Please

Lee on Feb 07 2009 | Filed under: Uncategorized

According to the Bureau of Labor Statistics there are 11.6 million unemployed persons in the United States today. Meanwhile, the current estimate of the total cost of the spending package passed to alleviate this distress is $827 billion. President Obama has framed his defense of this expenditure largely on job loss grounds. Lately he has gone so far as to warn that without passage of the package in full, the unemployment rate (currently at 7.6%) could hit double digits.

Let’s assume he’s right. Let’s even assume the total unemployment figure doubles to 23.2 million persons — a number which would likely require massive business failure and the collapse of entire industries to achieve. But for the price of the recovery package to head this off, we could afford to pay each of these 23.2 million future unemployed persons over $35,000 a year…which is almost exactly what the average individual income in the United States was in 2008. But here’s the thing, we wouldn’t have to pay them that, because there aren’t 23.2 million persons unemployed yet. Maybe there will be at some point in the future, but then again maybe there won’t.

The staggering expansion of government spending we are witnessing from those who used to restrict their advocacy to social safety nets for if someone happened to fall, is enough to make you nostalgic. Nostalgic for the days of profligate and wasteful welfare benefits, which seem positively frugal compared to this new invoice. Bring back the caricature welfare queen says me, with her Cadillac in a public housing garage. Incidentally, the base price for a Cadillac CTS is about $35,000 too. We could buy every currently unemployed person two of them with that recovery bill’s price tag.

Looking backward, the great value of the welfare system is that it is reactive, individual and conditional. That is to say, you have to personally lose your job in order to receive federal benefits. Now we’re apparently shifting to a model where massive indirect economic assistance is rendered for people who are currently still employed, because they might become unemployed at some point in the future. I prefer the old model in retrospect.

Sphere: Related Content

BOHICA

Keith_Indy on Feb 06 2009 | Filed under: Around the Web

There’s a lot that can be said about the “stimulus bill” winding it’s way through our legislative process, but nothing compares with just seeing what’s in the bill. McQ over at QandO does a good job of breaking it down (via NRO.)

Sphere: Related Content

Lee on Dec 05 2008 | Filed under: Domestic Politics, Libertarianism

I found myself complaining to a Libertarian colleague of mine today (note the capital ‘L’), about the deplorable political consensus that has emerged on the bailout strategy for economic resuscitation. The bipartisan policy is a ghastly trifecta of the ineffective, unpopular and unstoppable. It is precisely the sort of situation that makes me slightly more sympathetic to the appeals of my third-party advocating friends.

My Libertarian colleague in this case gleefully protested, as he always does, that it was ultimately the voters fault, for having continued to vote Republican or Democrat despite his warnings. And yes, Joseph Heller was invoked once again to support the blame game. Voters won’t vote LP because the LP is powerless, but the LP is powerless because voters won’t vote LP. You’ve heard this little argument before of course, but how accurate is it really?

(more…)

Sphere: Related Content

Lance on Dec 02 2008 | Filed under: Domestic Politics, Economics, Humor, Lance's Page

By Fred Thompson. With only the most minor quibbles I not only laughed, but cried. Pretty much dead on:

The sad thing is that it isn’t only “liberal” economists, it is the meat of the profession and plenty of so called “conservative” politicians.

Hat Tip: McQ

Sphere: Related Content

Athens into Persepolis

Lee on Nov 20 2008 | Filed under: Domestic Politics, History

Rasmussen has polled the public on whether they agreed with President Bush’s characterization of capitalism as the “highway to the American Dream.” Only 44% voiced support for capitalism, 33% were undecided and 22% expressed opposition. A grim finding. Only Republicans marshaled an absolute majority of support for the system, commendably voting 4:1, independents had a plurality of support, and Democrats were evenly split.

It should be observed that it is not without historical precendent that a victorious power would quickly wish to transform itself into the image of the enemy it proved its system utterly superior to, rejecting the values and virtues which had enabled her to triumph, in favor of those which had condemned her adversary to defeat. Indeed, it’s a bizarre but relatively common historical temptation if considered.

Sphere: Related Content

A Solution to the Financial Crisis? Sharia!

Lee on Nov 20 2008 | Filed under: Economics

Italian economist Loretta Napoleoni (of Rogue Economics fame), blames the lingering financial crisis in part on the American War on Terrorism, which inaugurated an allegedly “suspicious attitude…toward Muslim investors.” She goes further though, and argues that the only solution to the turmoil lies in embracing the financial rules mandated by the doctrines of medieval Islamic Sharia:

Islamic finance is a system based in shariah law. Central principals include a prohibition against charging interest and a code of ethics for investments – for example, barring investments in prostitution. Napoleoni said these principals are actually quite similar to the principles of classical economics.

“A bank should be a profit organization, but the moment in which the social role is forgotten and the profit role takes over, then a bank is actually working against the people who are putting their money into the bank, the clients. Now that, of course, in Islamic finance could not happen, because there is this partnership between the client and the banks. There is a social commitment within finance which we had before, but we lost it.”

(UNM)

Makes sense. When you’re looking for lessons in the administration of an advanced, adaptive, and sophisticated modern financial system, clearly we have a lot to learn from economic titans like Yemen. Lately financial sharia in that country has produced a permanently premodern economy with 40 times the population of Vermont, subsisting on about 80% of Vermont’s annual GSP. Sounds like a good deal to me.

(more…)

Sphere: Related Content

Bits and Pieces: 11-18-08

Lance on Nov 18 2008 | Filed under: Lance's Page

Russ Roberts:”Oh Please-President Bush has lost the right to say this.”

Also, he has a great Mea Culpa on why he missed this, and a discussion that fits right into my theme about how many missed this meltdown, and advice for those of us who did and might think too much of ourselves:

I should mention first that the few people who did see it coming were not necessarily any wiser than anyone else. Some of them had predicted nine of the last five recessions. A stopped clock is right twice a day. Even those who claim to have foreseen this mess couldn’t make the case well enough to alarm very many other people. And if you want to know if they were really wise or just selling a different story because the market was less crowded on the pessimistic side, you’d have to look at their bank accounts. Did they put their money where their mouth was?

Wall Street and economics are littered with the figurative corpses of those who got a big call right and got lots of attention and then became a joke as their prescience proved to be just luck.

By the way, in answer to the last question, yes I did, on behalf of myself and our clients.

Oh heck, two other gems from Cafe Hayek’s Don Boudreaux:

As Milton Friedman wisely pointed out, “If you cut taxes and revenues go up, you haven’t cut taxes enough.”

Revenues have gone up. So tax cuts have been inadequate.

Also:

Popular sentiment has it backward: the bigger the unproductive firm, the more vital it is to let it fail.

Megan McCardle gives a touching and heartfelt explanation of why opportunity cost has to be considered in regards to GM in “Save the Rustbelt.”

Speaking of Megan, she has inspired a true decining institution to ask for a bailout:

But Megan McArdle at The Atlantic came up with a compelling argument:

“The news business is special. Without us, you wouldn’t know anything. Besides, it provides millions of low-paying, insecure jobs to overeducated yuppies who are going to move back home, into your basement, if you don’t do something, quick.

“And the news business is the other industry that can, all by itself, send the real economy into a tailspin. You think you’re worried about a depression now? We could make you really depressed. I’m not threatening, or anything; I’m just saying, it’s a nice country you’ve got here. It would be a real shame if someone convinced consumers to stop buying Blu-Ray players and shift their savings into canned guns and ammunition.”

Her colleague Ross Douthat added this:

“And remember — as a wise man once said, what’s good for The Atlantic is good for America.”

If it’s good for The Atlantic, it’s even better for Playboy. At least, that’s what we think.

Heck, I can get behind that!

Of course Glenn Reynolds has a similar theme with political partisanship:

FINALLY, A THIRD PARTY that I could get behind.

Meanwhile Hormel is betting that the present economic situation is a bullish sign for Spam! Fascinating stuff really, as Spam has a number of devotee’s. My wife spent time in Hawaii this summer studying Pearl Harbor, and came back and marveled at the many uses Spam is put to there, including in faux Sushi.

Unfortunately some of the latest data is really disturbing for everything else.

For those who commented on my two previous posts at QandO, thanks. I think the comments had more information than my posts, and gave me a good chance to flesh out a number of ideas.

Worried about what is in store for banks in Europe? You should be, and past history says it could be pretty ugly.

Finally, are stocks cheap? Is now a good time to be buying US stocks? Maybe so. Here are some things to think about.

Sphere: Related Content

Lance on Nov 17 2008 | Filed under: Economics, Investing, Lance's Page

The insufferable Peter Schiff has a video going around, which frankly, is just brilliant. He may be unpleasant at times, but he nailed this thing, and took mounds of abuse while doing so. More importantly, I KNOW HOW HE FEELS!

The resentment, irritation, condescension and, at times, outright hostility to my Cassandra act makes me wish I had a video of my own. Sigh…

Oh well, it pays to remember that Cassandra was right. I was never as sure of myself as Peter, but risk management isn’t about knowing you are right, but knowing what could go wrong and whether it is likely enough to act upon.

As an aside, Peter is no big government type, and he goes to prove that despite the media focusing on Roubini and others (who do deserve a lot of credit) that people across the ideological perspective warned of this. Thus having seen this coming is not the same as being correct about what to do about it, since those who saw the oncoming train differ markedly on that score.

Sphere: Related Content

De-leveraging

Lance on Nov 16 2008 | Filed under: Economics, Lance's Page

Given the topic of tonight’s podcast I thought a little visual data might help. First, the explosion in US debt:

Henry Blodget explains:

From the early 1920s through 1985, the average level of debt-to-GDP in this country was 155%. The highest peak in history (until the recent debt boom) was in the early 1930s, when debt-to-GDP soared to 260% of GDP. In the 1930s, the ratio then cratered to 130%, and it remained close to that level for another half century. (See chart below).

In 1985, we started to borrow, and last year, when we got finished borrowing, we had borrowed 350% of GDP. To get back to that 155%, we need to get rid of more than $25 trillion of debt.

Do we have to get back to 155% debt-to-GDP? No, we don’t have to. But given what happened after the 1920s, and given what people will probably think about debt when they get through getting hammered this time around, we wouldn’t be surprised if we got back there. It seems to be sort of a natural level.

The banks have written off $650 billion so far. So we suppose that’s a start.

That would mean reducing (de-leveraging) our economy’s debt load by 25 trillion. I have no idea how you cut even 10 trillion in debt without massive economic dislocation.

Sphere: Related Content

Playmates during crisis

Lance on Oct 20 2008 | Filed under: Economics, Lance's Page, social science

Does the object of our desire tend to change during tough times?

Yes, according to this paper on men’s preferences when it comes to Playboy’s models:

Consistent with Environmental Security Hypothesis predictions, when social and economic conditions were difficult, older, heavier, taller Playboy Playmates of the Year with larger waists, smaller eyes, larger waist-to-hip ratios, smaller bust-to-waist ratios, and smaller body mass index values were selected. These results suggest that environmental security may influence perceptions and preferences for women with certain body and facial features.

For those wishing to do their own analysis you can download the data here. Tyler Cowen notes that the hypothesis is not fully supported by 2008’s selection.

Sphere: Related Content

Scamming

MikeR on Sep 23 2008 | Filed under: MikeR's Page

Dear American:

I need to ask you to support an urgent secret business relationship with a transfer of funds of great magnitude.

I am Ministry of the Treasury of the Republic of America. My country has had a crisis that has caused the need for a large transfer of funds of 800 billion dollars US. If you would assist me in this transfer, it would be most profitable to you.

I am working with Mr. Franklin Raines, who will be my replacement as Ministry of the Treasury in January. You may know him as the Chief Economic Advisor for Senator Obama’s presidential campaign, and the former head of Fannie Mae from 1999 to 2006.

Let me assure you that this transaction is 100% safe. Mr. Raines is completely trustworthy with your money. His record speaks for itself.

This is a matter of great urgency. We need a blank check. We need the funds as quickly as possible. We cannot directly transfer these funds in the names of our close friends because we are constantly under surveillance. My family lawyer advised me that I should look for a reliable and trustworthy person who will act as a next of friend so the funds can be transferred. Please reply with all of your bank account, IRA and college fund account numbers and those of your children and grandchildren to [email protected] so that we may transfer your commission for this transaction. After I receive that information, I will respond with detailed information about safeguards that will be used to protect the funds.

Yours Faithfully

Henry “Hank” Paulson

Minister of Treasury

Sphere: Related Content

Consumers get credit for their part in the debacle

MikeR on Sep 20 2008 | Filed under: Around the Web, MikeR's Page

Washington Post

This is not good news for consumers. Reminds me of Phil Gramm’s “whiners” comment. “Wall Street has lived beyond its means, but so has Washington. Both did so, in part, because consumers and voters on Main Street wanted it that way. They craved cheap credit to spend on imported goods, and they resisted tough tax and spending decisions. That, too, must change, lest this generation’s costly excesses end up crushing opportunities for its children and grandchildren.”

Sphere: Related Content

MikeR on Aug 28 2008 | Filed under: Around the Web, MikeR's Page

George Reisman’s Blog

“The loot?and?plunder theory is the theory of Obama, of the Democratic Party, and of much of the Republican Party. It is time to supplant it with the sound economic theory developed by generations of intellectual giants ranging from Smith and Ricardo to Böhm-Bawerk and Mises.”

Sphere: Related Content

Lance on Aug 05 2008 | Filed under: Economics, Lance's Page, Philosophy

Alex Taborrak has a story:

How an Economist Thinks

Over the weekend a crew came round my neighborhood offering to paint house numbers on the curb. Large bold curb numbers, they pointed out, make it easier for emergency service workers to find houses in the dark. Good argument. The price was good too. Then I noticed my neighbors were having their numbers painted. So of course, I declined.

The comments explode with wonderful econ geek goodness.

Sphere: Related Content

Creative Capitalism

Lance on Aug 02 2008 | Filed under: Developmental economics, Economics, Lance's Page

I think this is a fascinating blog, Creative Capitalism. Of Course, I am a geek.

Creative Capitalism: A Conversation is a web experiment designed to produce a book — a collection of essays and commentary on capitalism, philanthropy and global development — to be edited by us and published by Simon and Schuster in the fall of 2008. The book takes as its starting point a speech Bill Gates delivered this January at the World Economic Forum in Davos. In it, he said that many of the world’s problems are too big for philanthropy–even on the scale of the Gates Foundation. And he said that the free-market capitalist system itself would have to solve them.

This is the public blog of a private website where a group of invited economists have spent the past couple of weeks criticizing and debating those claims. Over the next couple of months we’ll be posting much of that material here, in the hopes of eliciting public commentary. Some of the public commentary — the comments posted on this blog — will also be used in the book. (Comments to the effect of “capitalism is evil and Bill Gates is a fool” probably won’t be used. But we’re genuinely open to opinions of all stripes, and all of the contributors who do end up in the finished product will be paid on a per-word basis, which should work out to between one and two dollars per word.)

The same goes for economics bloggers who write about the stuff here on their own sites: If we can get permission, we’d like to use that material too.

This is the kind of fertile collaboration that the internet has made possible.

I am especially enjoying the discussion between William Easterly, Paul Ormerod and Elizabeth Stuart. Start here and follow the conversation. Lots of discussion of Hayek and the institutions compatible with capitalism.

Sphere: Related Content

Happy Birthday Milton: Video Link Fixed

Lance on Aug 01 2008 | Filed under: Lance's Page, Milton Friedman Memorial Page

It is Milton Friedman’s birthday! For all kinds of coverage, go to my Milton Friedman Memorial page. Scroll to the bottom and there is a huge collection of thoughts on his passing. Here is one of my favorite bits:

Sphere: Related Content

How Supermarkets Can End Poverty

Lee on Aug 01 2008 | Filed under: Developmental economics, Economics, Foreign affairs, Lee's Page

Namibian supermarket selection (photo: Olivier Peyre)

One of great inequities in the modern world is that in relative terms, food in poor and starving countries often costs far more than in the wealthy developed world. That’s because industrial countries tend to be dominated by large supermarket chains, which can achieve enormous economies of scale in volume sales, and thus are able to offer dramatically cheaper food prices to consumers.

The difference between the benefits of traditional and supermarket retail food sales can be staggering even within the same country. In an unevenly developed country such as India, which is divided between urban chain supermarkets and rural traditional markets, the cost of vegetables is 33% cheaper in the city than for the rural poor dependent on small local stores.

This has larger economic implications than is generally acknowledged, as food purchases consume a far larger share of national wealth in the developing world. In poor countries such as Nepal, food spending can account for as much as 50% of consumption expenditure in middle income households, compared to 15% in the United States. Thereby a cruel kind of trap is created through high food prices, which precludes consumer spending on goods and services that command higher wages than agriculture can provide.

Thus, if you were able somehow to reduce the cost of food in the developing world, and thereby the share of consumer income it eats, you could free up large reservoirs of capital to the benefit of the broader economy’s development.

(more…)

Sphere: Related Content

Select Rants

Lance on Jul 28 2008 | Filed under: Domestic Politics, Economics, Lance's Page, Media

For those of you who love New York Times bashing, I am in rant mode at Risk and Return. What a bunch of balderdash.

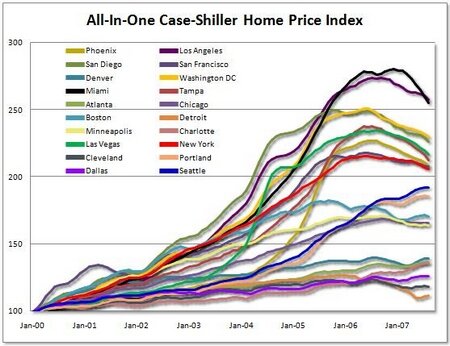

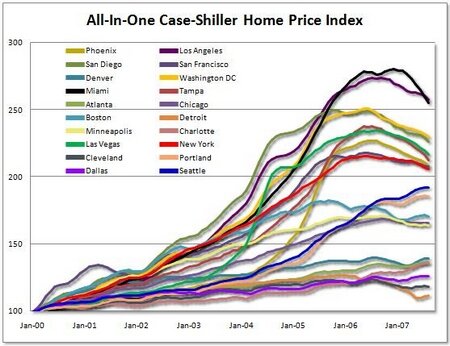

Also, if you want a good idea of where housing prices may go, I also have this. Charts, I have lots of charts!

Finally, I really hate the housing bill.

Sphere: Related Content

Greg Mankiw for President

Peg on Jul 25 2008 | Filed under: Domestic Politics, Economics, Peg's Page

Is it really too late for him to be a candidate?

Too bad. Mankiw’s platform surely would be our nation’s best.

Mankiw coyly calls it “pandering.” I call it a breath of fresh air – along with refreshing rationality.

No wonder most of it doesn’t have a snowball’s chance in hell of getting implemented.

Sphere: Related Content

I love this map

Lance on Jul 24 2008 | Filed under: Economics, Lance's Page

The one right here.

Here is a picture, but the real one is cool, cool cool.

You can find other maps like this here.

Sphere: Related Content

This is well timed

Lance on Jul 24 2008 | Filed under: Around the Web

Two straight weeks of 400k+ jobless claims (the level we have been told signals a recession) and the making it more expensive to hire low skilled employees by 12%. How about that for well thought out government policy.

Sphere: Related Content

MichaelW on Jun 28 2008 | Filed under: Domestic Politics, Economics, Election 2008, MichaelW's Page

From an interview by Stephen Moore (HT: GR):

So what if a President Barack Obama were to impose 50% or 60% tax rates on these CEOs and other big earners? Mr. Gramm pounces: “When you help a company raise capital, to put its idea to work, and you create jobs, those jobs are the best housing program, education program, nutrition program, health program ever created. Look, if a man in one lifetime is responsible for creating 100 real jobs, permanent jobs, then he’s done more than most do-gooders have ever achieved.”

And this:

“Why is America the richest country in the world?” he asks. “It’s not because our people are more brilliant; it’s because we have a better free-market system. Why has Texas created 1.6 million jobs in the last 10 years whereas Michigan has lost 300,000 jobs and Ohio has lost 100,000 jobs? Because governance matters, taxes matter, regulation matters. Our opponents in this campaign are so dogmatic in their goal of having more government because they love the power it brings to them that they’re willing to let it impose costs on the working people that they say they want to help. I am not.”

Gramm is apparently advising John McCain’s campaign. It could use the help.

Sphere: Related Content

MichaelW on Jun 09 2008 | Filed under: Domestic Politics, Economics, Media, MichaelW's Page, energy, regulation

When the most recent unemployment numbers were released, the media bleated about the highest percentage increase in the jobless rate since 1986. For example, The New York Times lamented:

When the most recent unemployment numbers were released, the media bleated about the highest percentage increase in the jobless rate since 1986. For example, The New York Times lamented:

The unemployment rate surged to 5.5 percent in May from 5 percent, the largest monthly spike in more than two decades, as the economy shed 49,000 jobs for a fifth month of decline, the Labor Department reported on Friday.

Economists construed the weak monthly jobs report as an indication of the pain assailing tens of millions of Americans amid an economic downturn that most experts assume is a recession.

The labor market is continuing to deteriorate, eroding the size of paychecks, just as gasoline and food prices surge, and as the declining value of real estate erodes the wealth and credit of many households.

Ed Morrissey was quick to point out why the numbers don’t support what the media narrative claims:

Up to now, employment had held steady through a rocky economy barely staying out of recession. In May, that changed for the worse, as unemployment rose to its highest level since October 2004. However, only 49,000 workers lost their jobs, which doesn’t nearly account for the four-tenths rise … The real story here is unemployment among entry-level workers to the employment system. In summer, teenagers and college students enter the marketplace looking for seasonal and part-time work. This accounts for the significant rise in job-seekers and the 0.4% increase in unemployment. Otherwise, an overall job loss of 49,000 jobs would account for a 0.04% increase in a market of 138 million workers.

.JPG)

King Banaian also took a look at the May numbers (in comparison with April), and while he disagrees somewhat with Ed’s account for the number of new entrants to the job market, he finds validity with respect to the rise in the unemployment rate: (more…)

Sphere: Related Content

Joshua Foust on Jun 09 2008 | Filed under: Economics

How remarkable:

As luxury fashion has become more expensive, mainstream apparel has become markedly less so. Today, shoppers pay the same price for a basic Brooks Brothers men’s suit, $598, as they did in 1998. The suggested retail price of a pair of Levi’s 501 jeans, $46, is about $4 less than it was a decade ago. A three-pack of Calvin Klein men’s briefs costs $21.50, only $3.50 more than in 1998. Which is the better buy?

Factoring for inflation, each of these examples is actually less expensive today. In current dollars, the 1998 suit would cost $788, the jeans would be $66 and the underwear would be nearly $24. As consumers adjust to soaring prices for gasoline, food, education and medical care, just about the only thing that seems a bargain today is clothes — mainstream clothes, anyway.

Clothing is one of the few categories in the federal Consumer Price Index in which overall prices have declined — about 10 percent — since 1998 (the cost of communication is another). That news may be of solace to anyone whose budget has been stretched just to drive to work or to stop at the supermarket; in fashion, at least, there are still deals to be had.

Read the whole thing. Virginia Postrel was really on to something.

Sphere: Related Content

Silent Tsunami

Peg on Apr 23 2008 | Filed under: Developmental economics, Economics, Peg's Page

As an update to this previous post, be sure to read this from The Economist.

Governments ought to liberalise markets, not intervene in them further. Food is riddled with state intervention at every turn, from subsidies to millers for cheap bread to bribes for farmers to leave land fallow. The upshot of such quotas, subsidies and controls is to dump all the imbalances that in another business might be smoothed out through small adjustments onto the one unregulated part of the food chain: the international market.

For decades, this produced low world prices and disincentives to poor farmers. Now, the opposite is happening. As a result of yet another government distortion—this time subsidies to biofuels in the rich world—prices have gone through the roof. Governments have further exaggerated the problem by imposing export quotas and trade restrictions, raising prices again. In the past, the main argument for liberalising farming was that it would raise food prices and boost returns to farmers. Now that prices have massively overshot, the argument stands for the opposite reason: liberalisation would reduce prices, while leaving farmers with a decent living.

There is an occasional exception to the rule that governments should keep out of agriculture. They can provide basic technology: executing capital-intensive irrigation projects too large for poor individual farmers to undertake, or paying for basic science that helps produce higher-yielding seeds. But be careful. Too often—as in Europe, where superstitious distrust of genetic modification is slowing take-up of the technology—governments hinder rather than help such advances. Since the way to feed the world is not to bring more land under cultivation, but to increase yields, science is crucial.

The record of governments trying to manage markets is woefully poor. Free markets assuredly are not free from their own anomalies and swings; witness our current real estate difficulties. Nevertheless, even with all their flaws, free markets are superior to the alternatives.

Sphere: Related Content

Lance on Apr 19 2008 | Filed under: Economics, Lance's Page

While spending increased in March by 1.8% over a year ago, adjusted for inflation it was way down. The only reason sales were positive was gasoline, though food sales were positive. Even there, that is mostly due to inflation and rising prices of food and staples.

Sphere: Related Content

Joshua Foust on Apr 17 2008 | Filed under: Developmental economics, Economics, Foreign affairs, regulation

Posted first at Registan.net

When last I touched on the global food crisis and how it is impacting Afghanistan and the rest of Central Asia, I noted that countries continuing to ban wheat exports would make the problem worse by restricting the global market, driving up prices even more, and limiting national coping mechanisms. One of the countries producing a glut of wheat this year was Kazakhstan, whose farmers were enjoying rather handsome profits from the wheat trade. Until now.

Kazakhstan joined other Black Sea grain exporters in curbing shipments on Tuesday, suspending wheat exports until Sept. 1 to combat double-digit inflation in Central Asia’s largest economy.

Analysts said they expected the ban, which excludes flour and will take effect 10 days from now, to cause a short-term spike in world wheat prices as supplies from Russia and Ukraine are already constrained by export limits or tariffs.

This is not insignificant. While Kazakhstan couldn’t lower world prices too much with Australia in a serious rut, an export ban not only fuels price hikes (which are affected by perception as much as supply), but is seriously bad news for poor people trying to feed their families everywhere. As friend-of-Registan.net neweurasia.net notes:

The other four Central Asian countries all import Kazakh grain, and the poor in all countries have been hit severely by recent price surges… Much of the region’s southern arable land is primarily used for growing cotton and cannot easily be converted into growing food crops.

Let’s hope that global food price inflation will come down during this year so that the Kazakh export ban really only has to last until September.

Yes, let us hope. Ben linked to some other interesting local anecdotes about how grain prices are adversely affecting quality of life in most of Central Asia, and they’re worth a read.

Kazakhstan’s behavior is confusing: though it is a much better reaction than a price freeze, an export restriction is of dubious benefit for combating inflation. Inflation is caused when money and credit increase out of proportion with an economy’s ability to produce goods and services. An export ban effectively limits the amount of goods Kazakhstan can produce by harming exporters—the Reuters report speculated it could potentially cause $800 million in losses.

(more…)

Sphere: Related Content

Lance on Feb 21 2008 | Filed under: Around the Web

Departing director of the National Bureau of Economic Research, Martin Feldstein, on the economy, credit markets and a lot more in his latest opinion piece and discussion on the Charlie Rose show.

Sphere: Related Content

Lance on Feb 14 2008 | Filed under: Economics, Lance's Page, Urban planning and development, regulation

So claims Alex Tabarrok. Alex and his blogmate Tyler are two of my favorite bloggers, but on this matter I think Alex is wrong. Unlike for some, his argument doesn’t invite scorn from me, because humility should teach us that sometimes things are different, and we cannot always fully understand why, at least not until after the fact. Later people laugh at we fools for missing the obvious. It always seems obvious after the fact. A belief in uncertainty is a virtue in understanding markets, and history. That being said, I still think Alex is wrong.

The crux of his argument is this:

So if the massive run-up in house prices since 1997 was a bubble and if the bubble has now been popped we should see a massive drop in prices. But what has actually happened? House prices have certainly stopped increasing and they have dropped but they have not dropped to anywhere near the historic average (see chart in the extension). Since the peak in the second quarter of 2006 prices have dropped by about 5% at the national level (third quarter 2007).

Except the argument has never been that prices would decrease immediately or quickly. The consensus of those of us who have worried about this has been that it would be a transition which would take years. Housing doesn’t correct quickly as a rule.

Alex feels the market has shifted to a new higher equilibrium:

If we don’t see the massive drop back to “normal” levels then the run up in prices should be described as a shift to a new equilibrium – much as happened during World War II – see the chart. (It’s an important question to ask what changed and why?). In the shift to the new equilibrium there was some mild overshooting, especially due to the subprime over expansion, but fundamentally there was no housing bubble.

I actually agree that in some markets we may see a new higher equilibrium, say California, but it will take a large drop first. Here is the chart showing price declines from above, but updated to reflect recent declines (Alex’s chart is old)

(more…)

Sphere: Related Content

Blood For Oil

MichaelW on Feb 11 2008 | Filed under: Economics, Foreign affairs, Hugo Chavez, MichaelW's Page, energy

Joseph Kennedy II supports blood for oil.

In recent months, my TV has been bombarded with ads from Joe Kennedy promoting his Citizens Energy program, such as the following:

The heating oil distributed by Citizens Energy comes from Venezuela on a subsidized basis (which its been doing since 1979). Since Hugo Chavez took the reins of power in 1998, those donations, and the support of Kennedy’s charity, have had decidedly more political overtones. (more…)

Sphere: Related Content

A Chicken in Every Pot

Peg on Feb 07 2008 | Filed under: Domestic Politics, Economics, Election 2008, Peg's Page

Have you ever met a politician who didn’t make promises that could not be delivered? I haven’t, either.

Have you ever met a politician who didn’t make promises that could not be delivered? I haven’t, either.

Of course, there are promises… and then there are promises.

If you are someone with an adjustable rate mortgage who has run aground, then you might like Hillary Clinton’s promise to freeze interest rates for five years. If you’re all the rest of us, however….

The Clinton proposal is a blunt tool applied too broadly to problems that are, in principle, contained and specific. Only 3.1 percent of prime (good credit) ARM loans are seriously (90 days or more) delinquent. The disconcerting delinquency rate of 16 percent is for the subprime sector–which is alarming, to be sure, but 84 percent are not seriously delinquent. Over the last three years there was an unusually large volume of aggressive lending activity with flaws at several levels. Some borrowers were led into loans they did not understand. These people deserve some concern. Other loans were made to speculators who do not live in the homes and were betting that house prices would continue to go up. The inhabitants of these homes deserve our concern, but the investors do not. It is now clear that there were too few checks and controls to assure reasonable loan underwriting practices (for example, no escrow accounts for taxes and insurance) or even good recordkeeping.

An accurate assessment of the current mortgage problem would probably reveal no more than 700,000 loans with distressed borrowers. Why, then, would the U.S. government rewrite eleven million loans, or even all 3.4 million subprime mortgages? Any intervention should be targeted at the borrowers who are truly in trouble, especially those who were likely duped by unscrupulous mortgage lenders. The numbers suggest these victims are disproportionately poor, young, and African American. Looking forward, the government needs to take steps to make this market more transparent and make it easier for borrowers to make good choices. But it would be irresponsible to do this by ruling millions of legal contracts null and void.

Senator Clinton’s policy amounts to a command-and-control approach to economic policy in which the government announces prices and tells suppliers what to produce. Undertaking such an intervention can only raise interest rates on mortgages (and maybe other interest rates as well) as markets attempt to incorporate risk premiums to cope with possible future interventions. Promising the American people that you can fix things by just lowering their interest rates is dishonest, a fairy tale that won’t come true.

I’m all for examining various remedies to modify the pain from the current mortgage and housing difficulties. Yet, the notion that we should undertake to destroy contracts and the relationships between investors and lenders is a bit frightening.

Of course, I find a lot about Senator Clinton to be on the frightening side….

Sphere: Related Content

Lance on Feb 06 2008 | Filed under: Developmental economics, Domestic Politics, Economics, Election 2008, Lance's Page

In electing a President we are rarely presented with candidates who represent our views, so in the end it really comes down to prioritizing. Frankly I may yet again not vote for a major party candidate, but if I do one is sue of great importance to me, though not mentioned nearly often enough, is a candidates devotion to free trade.

sue of great importance to me, though not mentioned nearly often enough, is a candidates devotion to free trade.

This is not merely because of its importance to our own economic health, though the negative impact if the views of Hillary were to become actual policy would be extremely negative. The consequences would far outstrip the housing and credit crisis that is presently plunging us into recession.

Of even greater importance to those of us who are not nationalist in our views, is the impact upon billions of others, primarily the impoverished people of Africa and Asia. The transformation in the living standards of the people’s of Asia over the last twenty years has been overall the most important story for mankind by far in most of our lifetimes. A breakdown in the global trading system would cause more suffering than al Qaeda can even contemplate.

So read this by David Ranson for a review of what the candidates have said about trade. Obama seems preferable to Hillary, though his rhetoric is vague. However, his hiring of Austen Goolsby gives me some comfort.

So read this by David Ranson for a review of what the candidates have said about trade. Obama seems preferable to Hillary, though his rhetoric is vague. However, his hiring of Austen Goolsby gives me some comfort.

On the Republican side the clear favorite should be McCain, though he has suggested some pretty expansive views on how to help dislocated workers adjust.

On this issue McCain is the clear choice overall.

Hat tip: Instapundit

Sphere: Related Content

Noneconomic Man in Modern Europe

Lee on Feb 05 2008 | Filed under: Culture, Economics, History, Lee's Page

photo: Tal Bright

Thomas Barnett bemoans the grotesque state of economics education in Europe, which often ranges from the anti-capitalist to the simply fatuous. But consider this item he cites:

Great French HS textbook: “Globalization implies subjugation of the world to the market, which constitutes a true cultural danger.”

(Thomas P.M. Barnett)

Somewhat bemused by this, Barnett asks “why is Europe so antagonistic on capitalism?” Perhaps the better question is why is Europe so antagonistic toward economics, because the item above isn’t really criticism of an economic philosophy. By elevating the primacy of culture over the market, we’re looking at the rejection of the economic premise, which is a concern for the material welfare of mankind. This is what Peter Drucker used to call the dream of “noneconomic man” and in his early work The End of Economic Man, he supplied some explanations for this impulse which might be of enduring relevance to Barnett’s question. (more…)

Sphere: Related Content

Sociology of Love

Lance on Feb 02 2008 | Filed under: social science

Yes, from the bird’s eye view, there is a “love market” and you are just a love widget. But let’s take the symbolic interactionist perspective. Relationships are highly customizable. Once you bond with a person, you can make the relationship highly unique and hard to substitute. Even if two people are similar, they can form very different relationships with different histories. If you’ve done that, then you’ve created a fairly unique thing that’s hard to replace. By yourself you might be generic, but in a relationship you can be very special.Translating back into econo-talk, people in loving relationships differentiate their “love product.” A person in a couple with a special history knows that there will never be another person who has lived the same life with them. That knowledge makes them stick it out. If you can do that in a way that improves both parties, then you won’t contribute to the optimal divorce rate.

More here.

Sphere: Related Content

Lance on Feb 02 2008 | Filed under: Economics, Investing, Lance's Page

The Fourth quarter GDP numbers came in this week, and then the Fed went ahead and cut rates further. That is 125 basis points in about a week.!

I have a roundup of news, related opinion and other reactions at Risk and Return.

Sphere: Related Content

Look Who Pays For Mitt-Care

MichaelW on Jan 29 2008 | Filed under: Domestic Politics, Election 2008, Health Care, MichaelW's Page

As governor of Massachusetts, Mitt Romney oversaw the implementation of state-wide universal health care, something that he touts as a major accomplishment on his campaign website. In fact, after signing the legislation into law, Romney penned a an Op-Ed for the Wall Street Journal extolling the virtues of the health care plan, even going so far as to hold it out as a model for other states to follow:

And so, all Massachusetts citizens will have health insurance. It’s a goal Democrats and Republicans share, and it has been achieved by a bipartisan effort, through market reforms.

[...]

Will it work? I’m optimistic, but time will tell. A great deal will depend on the people who implement the program. Legislative adjustments will surely be needed along the way. One great thing about federalism is that states can innovate, demonstrate and incorporate ideas from one another. Other states will learn from our experience and improve on what we’ve done. That’s the way we’ll make health care work for everyone.

Of course, many think Romney’s “accomplishment” is nothing to write home about, especially during a Republican primary race: (more…)

Sphere: Related Content

The Harley Report

Lance on Jan 25 2008 | Filed under: Economics, Investing

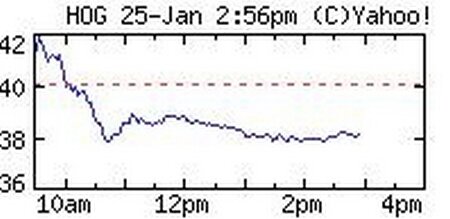

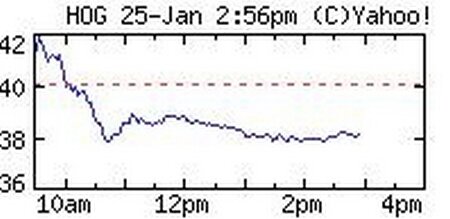

As I noted earlier, Dale Franks was curious about how Harley Davidson (HOG) would do on its latest earnings release:

As I noted earlier, Dale Franks was curious about how Harley Davidson (HOG) would do on its latest earnings release:

One earnings report to watch this week, though, is Harley-Davidson (HOG). It’s a solid company with a loyal customer base—I’m one of them actually—but, motorcycles are a luxury item. For every guy like me that rides practically every day, and uses a motorcycle as their primary transportation—there are about 10 guys that ride for maybe 2,000 miles a year. Or less. Those people are gonna stop riding—and buying—new motorcycles.

In fact, if the rumors are true, they already have, and Harley’s results for last quarter will be below analysts estimates. In the last year, Harley sold substantially fewer motorcycles than in 2006. Also, Harley’s stock has already lost about half of it’s value in the last year already, and disappointing earnings for last quarter won’t help.

The thing is, Harley is an interesting proxy for luxury buying. If Harley’s sales are looking bad on the 24th, when earnings are announced, that’s a pretty good indicator that consumers are shutting off buying non-essentials, a good indication of belt-tightening, and general economic cooling.

So what happened?

Revenue for the quarter was $1.39 billion compared to $1.50 billion in the year-ago quarter, a 7.7 percent decline. Net income for the quarter was $186.1 million compared to $252.4 million, down 26.3 percent versus the fourth quarter of 2006. Fourth quarter diluted earnings per share were $0.78, a 19.6 percent decrease compared to $0.97 in the fourth quarter of last year.

[...]

“Harley-Davidson managed through a weak U.S. economy during 2007,” said Jim Ziemer, Chief Executive Officer of Harley-Davidson, Inc. “As we announced in September, we reduced our wholesale motorcycle shipment plan for the fourth quarter, fulfilling our commitment to our dealers to ship fewer Harley-Davidson motorcycles than we expected our dealers worldwide to sell at retail during 2007,” said Ziemer.

[...]

Revenue from Harley-Davidson motorcycles was $1.12 billion, a decrease of $105.5 million or 8.6 percent versus the same period last year. Shipments of Harley-Davidson motorcycles totaled 81,206 units, a decrease of 11,642 units or 12.5 percent compared to last year’s fourth quarter.

[...]

U.S. retail sales of Harley-Davidson motorcycles decreased 14.2 percent for the quarter. The heavyweight motorcycle market in the U.S. decreased 9.0 percent for the same period.

[...]

For the full year of 2007, worldwide retail sales of Harley-Davidson motorcycles decreased 1.8 percent compared to the prior year. In the U.S., Harley-Davidson dealer retail sales decreased 6.2 percent for the full year; international retail sales increased by 13.7 percent. The U.S. heavyweight motorcycle market was down 5.0 percent for the full year of 2007.

To recap, miserable in the US, but offset to some degree by strong sales overseas. I think that meets Dale’s requirement for a bearish signal for the US economy. That was also at the low end of estimates. Yeah, it is getting whacked.

Thanks for visiting Risk and Return. Please feel free to contact us with any questions and/or comments. Please note our disclaimer.

Sphere: Related Content

Irrational Actors

Lee on Jan 24 2008 | Filed under: Around the Web

Michael Shermer examines the bizarre behavior of people in situations where they are forced to choose between relative money awards in social contexts. Remarkably, people will consistently choose less money, if more money would negatively affect their perception of their economic relationship to others.

Sphere: Related Content

Lance on Jan 23 2008 | Filed under: Economics, Election 2008, Investing, Lance's Page

Richard Rahn pushes for the indexing of capital gains due to inflation as part of the stimulus.

Accounting for inflation in this way has the advantages of producing more short-term revenue to the Treasury as long-term gains are “unlocked.” Furthermore, lowering the cost of capital would stimulate investment and the stock markets, and would increase the fairness of the tax system by not taxing phantom gains for people at all income levels. It would also square capital-gains taxation with the U.S. Constitution.

Assume you purchased a common stock in a company in 1984 for $100 a share and sold it in 2007 for $200 a share. Have you received any “income” from the sale of the shares of stock? The IRS would say “yes,” but this is clearly wrong. The IRS will claim that you had a $100 per share capital gain on the stock in the above example, yet actually the increase was solely a result of inflation. Because you cannot buy more goods and services with $200 now than you could have with $100 in 1984, you have had no “income” or wealth accretion.

Over the years numerous economists, lawyers and others have tried to fix this problem and have gotten nowhere with Congress. But now, due to increased concerns about inflation, economic growth and judicial salaries, the time may be right to move forward.

Pejman has his back.

Sphere: Related Content

Free Trade Distilled

Lance on Jan 22 2008 | Filed under: Domestic Politics, Economics, Lance's Page

Megan McCardle looks at some silly arguments at Max Sawickey’s old place on trade. Read the whole thing, but she hits the nail on the head here:

There are three possibilities for what will happen if we liberalize trade:

1) We will sell more stuff to foreigners than they sell to us. Since we can’t use all those funny banknotes, we will essentially be giving them free stuff.

2) Over the long run, we will sell about as much stuff to foreigners as they sell to us.

3) Over the long run, foreigners will sell us more stuff than we sell to them. Since they can’t use all those funny banknotes, they will essentially be giving us free stuff.

Sphere: Related Content

Price Controls in Iraq

Lee on Jan 21 2008 | Filed under: Around the Web

Remember the snow in Baghdad? It’s an unusually cold winter there this year. Yet kerosene is hard to come by. Gee, I wonder why: “Little kerosene is available on the state-run market at the subsidized price of $0.52 a gallon. But the fuel can be found on the black market, where it goes for more than $3.79 a gallon.” Price a good below the market price and demand erases supply.

Sphere: Related Content

Privatization Under Thatcher

Lee on Jan 20 2008 | Filed under: Around the Web

on Maggie’s privatization efforts in the 1980s, and the intellectual rationale behind expanding the investor class. It’s not about creating prosperity, it’s about educating a nation in what makes prosperity possible.

Sphere: Related Content

Lee on Jan 20 2008 | Filed under: Economics, Lee's Page

Click to enlarge

I thought the map Lance posted from the other day (originally from Strange Maps), which expressed the GDP of foreign countries as US states, based on their approximate equivalent GSP, was a pretty interesting visualization. However, I got to thinking what the same exercise might produce if the big boys were projected onto US geography. If you take the top five national economies in the world minus the US (Japan, PRC, Germany, UK), they easily fit into four macro GSP regions in the contiguous United States. I threw together the quick little map above from the data.

Incredibly, once you’ve applied the big four to the map, you will find that you still have around 800 billion dollars left to play with (including Alaska and Hawaii, which are not depicted). Underneath each country I included (in parentheses) how much additional money in US dollars you would have to add to the economies of each economic superpower to make them genuinely equal the collective GSP of each US region.

Sphere: Related Content

Lance on Jan 18 2008 | Filed under: Developmental economics, Economics, Lance's Page, Law, Libertarianism, regulation, social science

This is a stunning statistic:

This is a stunning statistic:

…the annual expansion in China’s trade has been larger than India’s total annual trade during last several years.

Tyler Cowen hones in on this point, amongst a bounty of good points:

The most important factor that still holds back large [Indian] firms from entering these products is a set of draconian labour laws in India. Under these laws, it is virtually impossible for a firm with 100 or more employees to fire the workers even in the face of bankruptcy. It is equally difficult for the firms to reassign the workers from one task to another. These provisions impose very low worker productivity or a high real cost of labour. Large-scale capital-intensive sectors such as automobiles, where labour costs are a tiny proportion of the total costs, can profitably operate in such an environment. But the same is not true of large-scale labour-intensive sectors labour. Few foreign manufacturers are willing to enter India outside of a small subset of capital- and skilled-labour intensive sectors.

These kinds of rules damage economies around the world, but countries with the enormous poverty present in India are the least able to afford the luxury of such self inflicted wounds. Which goes to the point of the first chapter of the latest Index of Economic Freedom report.

Economic Fluidity: A Crucial Dimension of Economic Freedom

This essay argues that whether the economic infrastructure is “successful” or “perverse” and whether the “reward structure” is conducive to innovation and entrepreneurship rests on the degree of economic fluidity. Without constant mixing across boundaries, without the creation and testing of ideas, and without learning and adaptation, the specific character of the institutional structure matters little. Fluidity determines whether or not the structure will be successful in facilitating growth.

It isn’t capital, natural resources or education, it is the opportunity for all of those things to be deployed and redeployed. Entrepreneurial activity.

Sphere: Related Content

ChrisB and the Federal Reserve

Lance on Jan 18 2008 | Filed under: Domestic Politics, Economics, Investing, Lance's Page, regulation

Chris asked what he thought the Federal Reserve could have done differently. I gave him an answer, but there was more to be said. My full answer is here. Scroll around, there is a lot more on the what could have been done, what might be done, and the general risks which now surround our economy.

Sphere: Related Content

Lee on Jan 17 2008 | Filed under: Around the Web

Morgan Stanley expects a “mild and short” recession in 2008, with peak unemployment of 5.6% or 5.7% in early 2009. Mark Perry points out that would make it the mildest and shallowest recession since the second world war.

Sphere: Related Content

Scary graphic of the day

Lance on Jan 15 2008 | Filed under: Domestic Politics, Economics, Lance's Page

From a post at the Minneapolis Star Tribune’s buzz.com describing the impact on neighborhoods in Minneapolis of the spiraling number of foreclosures. Each pin is a foreclosure. 725 total in North Side. (HT: Instapundit)

Sphere: Related Content

Lance on Jan 15 2008 | Filed under: Economics, Investing, Lance's Page

(cross posted at Risk and Return)

Paper Economy has taken a close look at what it will take to get inflation adjusted housing prices in Massachusetts back to trend over a five year period. It should be noted that for this to happen sooner the decline would have to be deeper (due to inflation doing less of the work for us.)

The following chart (click for much larger version) shows that in order to bring Massachusetts “real” home prices (as tracked by the OFHEO home price index for Massachusetts) in-line with the average annual return of 2.5% seen since the early 1970s, nominal prices have to complete a 16.8% decline (or 28.8% in “real” terms) from the latest peak.

(more…)

Sphere: Related Content

Capitalism Primer

MichaelW on Jan 15 2008 | Filed under: Economics, History, MichaelW's Page

Courtesy of Bookwork Room comes this 1948 classic “Fun and Facts about American Business.” It’s a cartoon short that portrays the birth of an entrepreneur, and how bringing his idea to fruition through hard work pays off not just for him, but also for his local community, and anywhere else his business expands to, bringing jobs, wealth and higher standard of living.

Enjoy (below the jump).

UPDATE: Related item at The Corner suggesting that Gov. Huckabee needs to have a gander at this video. It might explain to him just where he’s going wrong:

Governor, I didn’t have silver spoons or boarding schools or a verb summer, but I know enough to thank God for the job creators, the natural economic stimulators, capitalism.

(more…)

Sphere: Related Content

Globalization: By Don Boudreaux

Lance on Jan 14 2008 | Filed under: Books, Developmental economics, Economics, History, Lance's Page

(Cross posted at Risk and Return)

Cafe Hayek fans take note, it is finally out. Short review from Tyler Cowen:

This is the best popular book explaining the benefits of international trade. Imagine Bastiat for 2008, or a Cajun updating of Henry George’s Protection or Free Trade. Sadly it is expensive but I’d sooner give a student this book than say Henry Hazlitt’s Economics in One Lesson.

High praise. Here is Amazon’s description:

The contemporary era of globalization demonstrates that the local and global aspects of business and government are increasingly intertwined. Over the past fifty years, international business has evolved from the realm of the largest multinational corporations to the base scenario; every business and every citizen who participates in economic activity–by creating, buying, and selling products and services–is now a member of the global economy. But moving our thinking and actions beyond the local sphere is both challenging and problematic; the international domain is more complex, and introduces a new dimension of risks and uncertainties. Yet it it also ripe for business opportunity and wealth creation for those who learn how to navigate in it. Globalization defines and makes sense of the workings of the global economy–and how it influences businesses and individuals on a local scale. Each chapter identifies common questions and issues that have gained exposure in the popular media–such as outsourcing, the high cost of international travel, and the impact of a fast-growing China–to illustrate underlying drivers and mechanisms at work. Covering international trade, national wealth disparities (the haves vs. the have-nots), foreign investment, and geographical and cultural issues, and supported with illustrations, maps, charts, a glossary and timeline of key events, this volume illuminates the dynamics of the global economy and informs readers of its profound impact on our daily lives.

Sphere: Related Content

When the most recent unemployment numbers were released, the media bleated about the highest percentage increase in the jobless rate since 1986. For example,

When the most recent unemployment numbers were released, the media bleated about the highest percentage increase in the jobless rate since 1986. For example, .JPG)

As I

As I