Tag Archive 'economy'

Lance on Nov 08 2009 | Filed under: Economics, Investing, Lance's Page, Uncategorized

Employment as measured by the “establishment survey,” was down by 190,000; and Many feel it is an improvement that we are not falling as fast.

Well, let us take a moment to look under the hood of these numbers. First, while the establishment survey was down 190k, the number of unemployed soared by 558,000, to 15.7 million, as measured by the household survey. The establishment survey is taken from large businesses while the household survey calls individual households. It is the household survey that sets the unemployment rate. The establishment survey of companies doesn’t count the self-employed and undercounts employees of small businesses. So the economic picture is probably worse than the headlines when it comes to jobs.

(more…)

Sphere: Related Content

The Post-Post-American World

Lee on Nov 01 2008 | Filed under: Economics, Foreign affairs

So, did you enjoy the much discussed post-American world order? Hope you didn’t miss it. Surely it didn’t lack for advertising.

But if you did happen to step out for a moment, we just lived through the end of market capitalism, the death of the dollar, the collapse of American power, the cultural and political atrophy of the West, the rise of Eastern dictatorships to world leadership, and petrocracy as the vanguard political philosophy of the future.

Bill Emmott notices that a lot of this isn’t exactly plausible in historical context, and that with the collapse in the price of oil, a strengthening dollar, an even worse European recession and the unavailability of predicted competitive alternatives to American power…the post-post-American moment may be upon us.

(HT:

Sphere: Related Content

Synova on Oct 30 2008 | Filed under: Domestic Politics, Economics, Hugo Chavez, Libertarianism, Synova's Page

The idea of “Going John Galt” makes me a little bit uncomfortable, to tell the truth. John Galt essentially said screw them all, and shut down knowing that a whole lot of people would be hurt. It was about the only way he could make his point and make it stick.

Maybe we could do this without shutting down the economy?

But, as I think about it, a protest citing John Galt and out and out telling people what is going on might be a good idea, because people are going to go John Galt… quietly.

And I have no faith at all that anyone who now thinks that it’s a good thing to make the rich pay are going to understand what happened any more than Chavez or Mugabe understand what happened (or is happening) to their economies.

Sphere: Related Content

My favorite proposal for helping financial institutions

Lance on Oct 01 2008 | Filed under: Domestic Politics, Economics, Lance's Page

I do believe we should be doing something as a nation, through our government, to avoid the not insignificant chance of a total financial meltdown. I have seen several things proposed that I find interesting, and I will get into them and other longer term issues in coming days. I had hoped to address this all comprehensively, but time just isn’t allowing that, so let us do so piecemeal.

Today I would like to endorse one proposal that aligns exactly with my thoughts on this, which is we need to recapitalize banks in a more effective, less arbitrary manner while protecting taxpayers and homeowners as well.

(more…)

Sphere: Related Content

Scamming

MikeR on Sep 23 2008 | Filed under: MikeR's Page

Dear American:

I need to ask you to support an urgent secret business relationship with a transfer of funds of great magnitude.

I am Ministry of the Treasury of the Republic of America. My country has had a crisis that has caused the need for a large transfer of funds of 800 billion dollars US. If you would assist me in this transfer, it would be most profitable to you.

I am working with Mr. Franklin Raines, who will be my replacement as Ministry of the Treasury in January. You may know him as the Chief Economic Advisor for Senator Obama’s presidential campaign, and the former head of Fannie Mae from 1999 to 2006.

Let me assure you that this transaction is 100% safe. Mr. Raines is completely trustworthy with your money. His record speaks for itself.

This is a matter of great urgency. We need a blank check. We need the funds as quickly as possible. We cannot directly transfer these funds in the names of our close friends because we are constantly under surveillance. My family lawyer advised me that I should look for a reliable and trustworthy person who will act as a next of friend so the funds can be transferred. Please reply with all of your bank account, IRA and college fund account numbers and those of your children and grandchildren to [email protected] so that we may transfer your commission for this transaction. After I receive that information, I will respond with detailed information about safeguards that will be used to protect the funds.

Yours Faithfully

Henry “Hank” Paulson

Minister of Treasury

Sphere: Related Content

The Economic Message is Bad – Not the Economy

MikeR on Sep 13 2008 | Filed under: Around the Web, MikeR's Page

The Chronicles of the Conspiracy

“What does it say about our nation that it has become political suicide to state

the good news that our economy is not in recession?”

Sphere: Related Content

Cowed by Liberal Rhetoric?

MikeR on Sep 11 2008 | Filed under: MikeR's Page

AmSpec News

The economy is not booming but it is sound and growing. Emmet Tyrell says we are cowed by liberal rhetoric and can’t get this economic message out.

Did I say growing? Yes I did, but the Republicans cannot talk about the growing economy because if they did it would sound as though they had no compassion for those who are not doing particularly well in this economy. This is a rhetorical trick that the Democrats have imposed on the Republicans. So effective has it been in cowing the Republicans that quite possibly never again will a sitting president be able to boast of a record of economic achievement.

Is this another case of the “big lie” gaining traction?

Sphere: Related Content

Obama’s Plan: Does This Work?

Lee on Sep 11 2008 | Filed under: Domestic Politics, Election 2008

According to the Associated Press, a sequence of interviews with Democratic leaders has revealed this to be the political plan being recommended to the Obama campaign:

1. Tie the Republican to an unpopular President Bush.

2. Let no charge go unanswered.

3. Stress plans to fix the economy.

Well, I’m not sure any of these items is good advice, with a possible qualitative exception on #3.

(more…)

Sphere: Related Content

The End of the Anti-Bush Economy

Lee on Sep 10 2008 | Filed under: Around the Web

The impending collapse of the anti-Bush merchandise market spells doom for the national economy: “We need to develop totally new products for marginally politically active liberals to throw their money away on.”

Sphere: Related Content

Limited Government Still Popular

Lee on Sep 09 2008 | Filed under: Around the Web

According to a new Rasmussen survey 62% of Americans believe encouraging economic growth is more important than reducing income inequality. 51% also say the federal government exerts too much control over our economy as it stands. It would be wise of the McCain campaign to emphasize which candidates value which most.

Sphere: Related Content

Lee on Sep 03 2008 | Filed under: Economics, Foreign affairs

After forcefully savaging the Russian invasion of Georgia, controversial Swedish economist Anders Aslund lays out ten reasons he expects an impending economic collapse in Russia. Each point is sound, although some are more problematic than others.

Particularly cogent are the following Aslund points IMO:

4. Renationalization is continuing and leading to a decline in economic efficiency. When Putin publicly attacked Mechel, investors presumed that he had decided to nationalize the company. Thus, they rushed to dump their stock in Mechel, having seen what happened to Yukos, Russneft, United Heavy Machineries and VSMP-Avisma, to name a few. In a note to investors, UBS explains diplomatically that an old paradigm of higher political risk has returned to Russia, so it has reduced its price targets by an average of 20 percent, or a market value of $300 billion. Unpredictable economic crime is bad for growth.

5. The most successful transition countries have investment ratios exceeding 30 percent of GDP, as is also the case in East Asia. But in Russia, it is only 20 percent of GDP, and it is likely to fall in the current business environment. That means that bottlenecks will grow worse.

6. An immediate consequence of Russia’s transformation into a rogue state is that membership in the World Trade Organization is out of reach. World Bank and Economic Development Ministry assessments have put the value of WTO membership at an additional growth of 0.5 to 1 percentage points a year for the next five years. Now, a similar deterioration is likely because of increased protectionism, especially in agriculture and finance.

[...]

8. Oil and commodity prices can only go down, and energy production is stagnant, which means that Russia’s external accounts are bound to deteriorate quickly.

9. Because Russia’s banking system is dominated by five state banks, it is inefficient and unreliable, and the national cost of a poor banking system rises over time.

(Moscow Times via Robert Amsterdam)

As for all this leading to a Russian economic apocalypse, it should be noted that the accuracy of Aslund’s predictive powers leaves more than a little to be desired. I note that we’re still waiting for his prediction of a military coup against Medvedev to come true.

Sphere: Related Content

MikeR on Aug 25 2008 | Filed under: Around the Web

Economist

“The origin of this skills problem lies in the decline of the family in American society. Dysfunctional families retard the formation of the abilities needed for successful performance in modern society.”

Both the left and the right see the problem but I suspect the solutions are quite different.

Sphere: Related Content

Dissecting Subprime – A lesson learned

MikeR on Aug 22 2008 | Filed under: Economics, MikeR's Page

The Economist

Interesting article about the roots of the problem. What I found fascinating was this root cause.

the historical accident of a very low loss rate during the early history of subprime mortgage foreclosures in 2001-2002.

This is the reminder that “accidents” continue to happen and that our best models are always suspect. Lesson learned – events will continue to occur that challenge conventional thinking and assumptions. Some short term data (an accident) led investors to believe there was less risk and uncertainty.

This idea can be extrapolated to all models that try to describe large complex systems – like AWG.

Sphere: Related Content

Fail Early or Don’t Fail at All

Lance on Aug 03 2008 | Filed under: Domestic Politics, Economics, Lance's Page

From Slate

On tonights podcast at QandO, I called in at McQ’s request to discuss the economy. One of the things we discussed was the likelihood of our government continuing to bail out our financial institutions. For a number of reasons that will be problematic.

Of interest is how many institutions are likely to fail?

One way to look at that is to see what the market is implying. Weighted by assets, right now the market is pricing in about a 4% failure rate for just the next six months. That would be far above the S&L crisis’ peak, and over its full term it amounted to failures of 17% of total assets. The assets which would need to be absorbed….575 billion. How much capital would that require to absorb them….50 to 80 billion. There is only about half that available from other institutions to take them over. Of that, nearly half is in small institutions which will be of little help. As loans continue to go bad that capital is likely insufficient to cover their own losses. This implies much more raising of capital, and who is going to give it to them? Most people who were willing have already ponied up. JP Morgan and the Fed already took on Bear Stearns. Whose balance sheet is available?

The losers in this? Taxpayers and bondholders. Having just taken on Fannie and Freddie, and guaranteed their bondholders, I assume bondholders will have to start taking hits. The lesson might be for bondholders, if you are going to fail, fail early and fail spectacularly!

Sphere: Related Content

Peter Pan America

Lance on Jul 31 2008 | Filed under: Domestic Politics, Economics, Peg's Page

Growing up means accepting responsibility for your actions and attempting to make wise decisions as much as possible. Peter Pan rejected this; he didn’t want to grow up and lose the carefree, irresponsible days of youth.

Growing up means accepting responsibility for your actions and attempting to make wise decisions as much as possible. Peter Pan rejected this; he didn’t want to grow up and lose the carefree, irresponsible days of youth.

Too often, it appears that America today has accepted the mantle of a Peter Pan society. Adults choose poorly, or do little investigating prior to actions – and then expect the government to save them, over and over and over. The worst of it? The government does seem to step up to the plate, again and again.

When people are rewarded for bad behavior and never need to face the consequences of irresponsibility, do they then learn that these activities should not be repeated? I think not.

Professor Mankiw examines the upcoming mortgage bailout. Although Larry Summers is a very smart guy, I’m with Dick Armey on this one.

Americans who work hard, pay taxes and play by the rules can’t seem to get fair representation in Washington, D.C., these days. In the current debate over a government bailout of speculators, irresponsible banks, Fannie Mae and Freddie Mac, the responsible majority has once again been pushed aside in a legislative rush to “do something.”

This should have been a perfect opportunity for Republicans, struggling to regain some standing with the American people, to rise united and demand real accountability and reform.

Actions by Fannie and Freddie management and their regulators this year precipitated the current crisis. Under pressure from the Democrat-controlled Congress, the Bush administration lifted Fannie and Freddie’s portfolio caps in February and reduced their capital reserve requirements in March. In this year’s stimulus bill, Congress went further and nearly doubled the size of the loans that Fannie and Freddie can purchase or guarantee.

As a result of this reckless expansion, the government-sponsored enterprises (GSEs) now touch nearly 70% of all new mortgages. At the same time, they are insolvent by most measures. The ostensible purpose of Fannie and Freddie is to provide liquidity to America’s housing markets. In practice, they are the source of systemic risk and instability in a time of need.

I’m a Realtor. Passing bills to “bail out” the mortgage industry may well help me out a great deal – short term. But, I always try to have the “long view.” And, long term, putting bandaids on large wounds will only make facing the deep difficulties later more complex and significant.

Neither party is stepping up to the plate to honestly face our people and tell them that we cannot party forever like drunken teenagers. Very few of our leaders are willing to set examples with “tough love.” As long as we continue in this manner, we will leave one enormous mess for the next generations to clean up.

Where is Wendy when we need her?

Sphere: Related Content

The Amoral Nature of Moral Hazard

Lance on Jul 23 2008 | Filed under: Domestic Politics, Economics, Humor, Lance's Page

Joel Pett / Lexington Herald-Leader (July 17, 2008)

Sphere: Related Content

You Walk Away Hits Television

Lance on Jul 09 2008 | Filed under: Economics, Lance's Page

Cross posted at Risk and Return

You may remember the website we discussed back in January. Dale Franks just discovered their program, because they now are on Television. He asks the obvious question:

So, should the mortgage companies get off scott-free from facing the results of their poor business decisions when it comes to the loans—loans they shouldn’t have made in the first place?

From my comment there:

No, they shouldn’t. I don’t endorse walking away, but when you take out a loan, and offer collateral, it is assumed that one possible recourse is to give back the collateral. Since lenders don’t want that to happen, they are supposed to examine the worth of that collateral pretty carefully, and get some money down. That way it isn’t in the interest of the homeowner to “walk away” even if they don’t mind the damage to their credit.

The lenders didn’t do either, now people are returning the house when it is in their best interest. I don’t count on the benevolence of my bankers, I suggest they shouldn’t have counted on consumers to take it on the chin for their sake either. Nor do I want our government, or the Fed, to keep bailing them out, either directly or indirectly by helping people keep houses they cannot afford. Neither is likely to work anyway.

Sphere: Related Content

The Economy Makes Me Nervous As Well

Lance on Jul 04 2008 | Filed under: Economics, Lance's Page, Media

Yeah, this is kind of funny, if in a dancing on gravestones kind of way.

I hate to continue to beat an old drum, but the economic data is showing far less stress than is actually out there. Employment is far weaker than the commonly reported data is showing, inflation is running higher than the data shows, and thus the economy has likely been in contraction for some time, not barely above water as is usually reported

The worst is most likely still down the road.

I think the administration knows that, and I would be nervous as well.

Sphere: Related Content

MichaelW on Jun 28 2008 | Filed under: Domestic Politics, Economics, Election 2008, MichaelW's Page

From an interview by Stephen Moore (HT: GR):

So what if a President Barack Obama were to impose 50% or 60% tax rates on these CEOs and other big earners? Mr. Gramm pounces: “When you help a company raise capital, to put its idea to work, and you create jobs, those jobs are the best housing program, education program, nutrition program, health program ever created. Look, if a man in one lifetime is responsible for creating 100 real jobs, permanent jobs, then he’s done more than most do-gooders have ever achieved.”

And this:

“Why is America the richest country in the world?” he asks. “It’s not because our people are more brilliant; it’s because we have a better free-market system. Why has Texas created 1.6 million jobs in the last 10 years whereas Michigan has lost 300,000 jobs and Ohio has lost 100,000 jobs? Because governance matters, taxes matter, regulation matters. Our opponents in this campaign are so dogmatic in their goal of having more government because they love the power it brings to them that they’re willing to let it impose costs on the working people that they say they want to help. I am not.”

Gramm is apparently advising John McCain’s campaign. It could use the help.

Sphere: Related Content

Lance on Apr 12 2008 | Filed under: Domestic Politics, Economics, Election 2008, Firearms, Lance's Page

Given the discussion at this post about Obama’s condescension, I suggest Tom Maguire’s roundup of the coverage of Obama making the mistake of speaking his mind about the rubes who he needs to vote for him:

I can’t believe that in all those Harvard classes they never emphasize that you can’t tell the rubes what you really think of them. Surely they aren’t relying on the common sense of the elitist snobs passing through to figure that out themselves? Didn’t work!

For those not in the know, here is what he thinks, or at least wanted this audience to :

At issue are comments he made privately at a fundraiser in San Francisco last Sunday. He was trying to explain his troubles winning over some working class voters, saying they have become frustrated with economic conditions:

“It’s not surprising, then, they get bitter, they cling to guns or religion or antipathy to people who aren’t like them or anti-immigrant sentiment or anti-trade sentiment as a way to explain their frustrations.”

I really don’t have a problem with the guy, or, as McQ points out, that Obama’s claims of being some kind of “new” politician are a load of horse hockey. Marketing is the stuff of campaigning. I do have a problem with supporters who actually believe that load of BS.

Hmm, I do like this quote from Tom as well:

Bayh skips past the odd tension between Obama’s own opposition to free trade and his apparent belief that free trade opponents are embittered economic losers; maybe Barack opposes free trade on behalf of Michelle, who is struggling to get by on only $400,000 per year.

Heh, well so much for talking straight and holding a position from principle. Given his employment of Austan Goolsbee I think Obama is a free trader, he just doesn’t want us to know. Whether that should make one more likely to vote for him or not I have no idea. What is better? Wrong or insincere?

Update: McQ picks this theme up and goes a little deeper.

Sphere: Related Content

Ill chosen words… and digging deeper

Synova on Apr 12 2008 | Filed under: Domestic Politics, Synova's Page, Uncategorized

As at least one person has said, there’s the type of slip of the tongue where one accidentally says what one really thinks.Has everyone seen by now Obama’s take on why small town Midwestern sorts cling to religion, guns, racism, and anti-illegal immigrant notions? They’re bitter.

“It’s not surprising, then, they get bitter, they cling to guns or religion or antipathy to people who aren’t like them or anti-immigrant sentiment or anti-trade sentiment as a way to explain their frustrations.”

So now he’s conceded that his remarks were ill chosen and that of course religion and the second amendment are good things. He attempts to say the same thing but with better chosen words. He also seems to have left out the “antipathy to people who aren’t like them” part. (Which, frankly, I hadn’t seen anyone make much of a deal about but there is a lot I don’t see so…)

“Lately there has been a little typical sort of political flare up because I said something that everybody knows is true, which is that there are a whole bunch of folks in small towns in Pennsylvania, in towns right here in Indiana, in my hometown in Illinois who are bitter,”

My “home town” is between 200 and 300 people. I had to go to the next town for school and my graduating class numbered Forty-one. Anywhere that I have gone in my 20+ years of adult life no one has had the first clue of what “depressed local economy” actually means. They just don’t know.

(more…)

Sphere: Related Content

Are we in a recession yet?

Lance on Apr 07 2008 | Filed under: Economics, Investing, Lance's Page

Personally I think we have been negative since November. Given the large positive number in the third quarter, the barely above break even number in the fourth quarter virtually guarantees that the economy went negative sometime in November and December. However, if we are not, it is highly likely coming. Here is a graphic which should put it in perspective. From Moody’s we get this look at freight (Click to enlarge)

That is a pretty stunning collapse. Few things correlate with economic activity more than freight, and for rather obvious reasons.

While I have been very negative on the economy shorter term for some time, I will say I doubt this will be a particularly deep recession. On the other hand, I also expect it to be rather drawn out. Obviously I could easily be wrong on both counts.

I will repeat what I have said over and over, in a probabilistic world we cannot know the future, but we can say that the risks are rather high and we should all consider lowering the amount of risk we face. That means more cash in our savings accounts, more defense in your portfolios (if you are going to take risk, make it risk that doesn’t correlate with US financial markets) and reducing debt.

With both financial markets and housing prices I would be wary. Your situation may differ, but I keep hearing people say things must be attractive at this point. Housing is a much better deal than it was, etc.

That is exactly right, but I suspect that this also likely holds true. It is approximately 4 1/2 hours from Baton Rouge to Shreveport. Alexandria lies halfway between. When my children ask me how far we still have to go, while I undoubtedly have far less distance to go than when I started, I still have just as far to drive as I have already driven.

In many areas of the financial markets and housing things may be less expensive than they were, but they are still way too expensive and there is a lot more bad news coming down the pike.

Sphere: Related Content

Lee on Feb 11 2008 | Filed under: Economics, Lee's Page

![woman lighting cigarette]()

photo: Simón Pais-Thomas

Mick at Uncorrelated has another lovely post on the essentially vile character and politics of Mike Huckabee. Toward the end of his remarks he briefly hits Huckabee’s proposed Fair Tax:

…and politically DOA policy planks like the fair tax.

(Uncorrelated)

Politically DOA we must hope, because Huckabee’s tax plan would do more than “eliminate the IRS.” It would probably eliminate the US economy along with it.

(more…)

Sphere: Related Content

Scrambling for Africa: A Conversation with John Ghazvinian

Lee on Feb 02 2008 | Filed under: Books, Developmental economics, Economics, Foreign affairs, Interviews, Lee's Page

![Niger Delta Oil Shell oil venting]()

Gas flaring in the Niger Delta (photo: Ellie)

John Ghazvinian is a journalist and historian of considerable insight into African affairs. He also happens to have written one of the best recent books on the emergent international struggle for African petroleum: Untapped: The Scramble for Africa’s Oil (the paperback edition is due out in April). Whilst being an enormously valuable investigation of a very serious issue, it is also a page-turning and literate adventure into exotic and dangerous places. Indeed, one that’s practically impossible to put down once you’ve picked it up.

As John writes therein, since 1990 the oil industry has invested $20 billion in oil exploration and production in Africa, with $50 billion more planned before 2010. Over the next five years Chevron alone is devoting $20 billion in investment for Africa. Taken collectively, this exercise represents the largest commercial investment in African history. But such a spectacular windfall for some of the world’s most impoverished countries can be a poisoned chalice, where the brutal economic forces of the so-called “resource curse” hollow out states, eviscerate agricultural economies and break traditional cultures.

Populous and promising Nigeria for example, is one of the oldest and most well established oil producing countries in Africa. But with the expansion of Nigeria’s oil extraction industry, she has seen only the systematic erosion of her economic and civil society. As well as witnessing the transformation of her oil bearing region in the Niger Delta (one of the richest in the world), into a vast social wasteland of extreme poverty, rapacious crime and guerrilla warfare. As John notes, “Nigeria” is now a shorthand expression in Africa for what everyone with oil desperately wants to avoid.

John took some time out of his morning yesterday to sit down with me for a telephone interview. We were able to discuss a variety of subjects related to issues raised in his book. Including among other things, US oil supply diversification, the political consequences of offshore exploration in the Gulf of Guinea, the resource curse and rentier states, instability and post-nationalist militancy in the Niger Delta, oil field subculture, the labor problem, Chinese energy strategy in Africa and the difficulty of talking about Africa “without lapsing into sanctimoniousness” (as John puts it in the preface of his book). As I did, I believe you’ll find this to be a rather rewarding and unconventional discussion.

(more…)

Sphere: Related Content

Lance on Feb 02 2008 | Filed under: Economics, Investing, Lance's Page

The Fourth quarter GDP numbers came in this week, and then the Fed went ahead and cut rates further. That is 125 basis points in about a week.!

I have a roundup of news, related opinion and other reactions at Risk and Return.

Sphere: Related Content

Lance on Jan 30 2008 | Filed under: Economics, Society

youwalkaway.com

I really have little to add to my declaration of extreme discomfort.

Much more on this here.

Sphere: Related Content

The Harley Report

Lance on Jan 25 2008 | Filed under: Economics, Investing

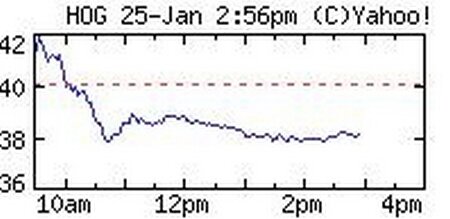

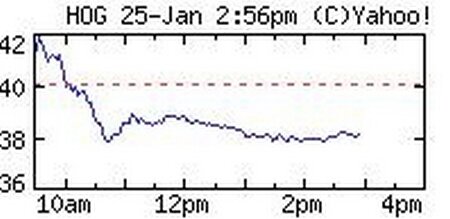

As I noted earlier, Dale Franks was curious about how Harley Davidson (HOG) would do on its latest earnings release:

As I noted earlier, Dale Franks was curious about how Harley Davidson (HOG) would do on its latest earnings release:

One earnings report to watch this week, though, is Harley-Davidson (HOG). It’s a solid company with a loyal customer base—I’m one of them actually—but, motorcycles are a luxury item. For every guy like me that rides practically every day, and uses a motorcycle as their primary transportation—there are about 10 guys that ride for maybe 2,000 miles a year. Or less. Those people are gonna stop riding—and buying—new motorcycles.

In fact, if the rumors are true, they already have, and Harley’s results for last quarter will be below analysts estimates. In the last year, Harley sold substantially fewer motorcycles than in 2006. Also, Harley’s stock has already lost about half of it’s value in the last year already, and disappointing earnings for last quarter won’t help.

The thing is, Harley is an interesting proxy for luxury buying. If Harley’s sales are looking bad on the 24th, when earnings are announced, that’s a pretty good indicator that consumers are shutting off buying non-essentials, a good indication of belt-tightening, and general economic cooling.

So what happened?

Revenue for the quarter was $1.39 billion compared to $1.50 billion in the year-ago quarter, a 7.7 percent decline. Net income for the quarter was $186.1 million compared to $252.4 million, down 26.3 percent versus the fourth quarter of 2006. Fourth quarter diluted earnings per share were $0.78, a 19.6 percent decrease compared to $0.97 in the fourth quarter of last year.

[...]

“Harley-Davidson managed through a weak U.S. economy during 2007,” said Jim Ziemer, Chief Executive Officer of Harley-Davidson, Inc. “As we announced in September, we reduced our wholesale motorcycle shipment plan for the fourth quarter, fulfilling our commitment to our dealers to ship fewer Harley-Davidson motorcycles than we expected our dealers worldwide to sell at retail during 2007,” said Ziemer.

[...]

Revenue from Harley-Davidson motorcycles was $1.12 billion, a decrease of $105.5 million or 8.6 percent versus the same period last year. Shipments of Harley-Davidson motorcycles totaled 81,206 units, a decrease of 11,642 units or 12.5 percent compared to last year’s fourth quarter.

[...]

U.S. retail sales of Harley-Davidson motorcycles decreased 14.2 percent for the quarter. The heavyweight motorcycle market in the U.S. decreased 9.0 percent for the same period.

[...]

For the full year of 2007, worldwide retail sales of Harley-Davidson motorcycles decreased 1.8 percent compared to the prior year. In the U.S., Harley-Davidson dealer retail sales decreased 6.2 percent for the full year; international retail sales increased by 13.7 percent. The U.S. heavyweight motorcycle market was down 5.0 percent for the full year of 2007.

To recap, miserable in the US, but offset to some degree by strong sales overseas. I think that meets Dale’s requirement for a bearish signal for the US economy. That was also at the low end of estimates. Yeah, it is getting whacked.

Thanks for visiting Risk and Return. Please feel free to contact us with any questions and/or comments. Please note our disclaimer.

Sphere: Related Content

Lee on Jan 20 2008 | Filed under: Economics, Lee's Page

Click to enlarge

I thought the map Lance posted from the other day (originally from Strange Maps), which expressed the GDP of foreign countries as US states, based on their approximate equivalent GSP, was a pretty interesting visualization. However, I got to thinking what the same exercise might produce if the big boys were projected onto US geography. If you take the top five national economies in the world minus the US (Japan, PRC, Germany, UK), they easily fit into four macro GSP regions in the contiguous United States. I threw together the quick little map above from the data.

Incredibly, once you’ve applied the big four to the map, you will find that you still have around 800 billion dollars left to play with (including Alaska and Hawaii, which are not depicted). Underneath each country I included (in parentheses) how much additional money in US dollars you would have to add to the economies of each economic superpower to make them genuinely equal the collective GSP of each US region.

Sphere: Related Content

A New Voice Coach?

Lee on Jan 18 2008 | Filed under: Around the Web

Hillary has been modifying her voice lately. A new TV spot on the economy in California. Soooothing and feminine. Much improved .

Sphere: Related Content

Lee on Jan 17 2008 | Filed under: Around the Web

Morgan Stanley expects a “mild and short” recession in 2008, with peak unemployment of 5.6% or 5.7% in early 2009. Mark Perry points out that would make it the mildest and shallowest recession since the second world war.

Sphere: Related Content

Germany in the Black…for Now

Lee on Jan 16 2008 | Filed under: Around the Web

Germany has finally balanced its budget after 38 years of failure. The cause is an export driven 2006-2007 boom. What constitutes an economic boom in Germany these days? 2.5% annual GDP growth. Quite a decline by the standard of West German booms. One wonders whether Thatcher’s concerns about the economic impact of a reunified Germany were misplaced, at least for our lifetimes. And things are regressing in 2008, with the government publicly expecting 2% growth and a return to federal deficit spending.

Sphere: Related Content

Lee on Jan 16 2008 | Filed under: Around the Web

Hyundai is contemplating pulling its Superbowl advertising, citing sudden concerns about US economic indicators. Traditionally ad budgets are the first to go when firms start believing they’re entering a recession. Not the most encouraging news of the day.

Sphere: Related Content

Lee on Jan 12 2008 | Filed under: Foreign affairs, History, Lee's Page, Uncategorized

![Swaziland Sunrise]()

(photo: Michael Deeble)

With heavy rains flooding Southern Africa and displacing thousands, surely saving graces must be found in parched and dying Swaziland, a country long thirsting for a drop of rain. But somewhat typically, that oppressed country’s autocrat King Mswati III, has taken the event of the rain for more than it is, and in so doing has begun another trek away from the path of reform.

The other day Mswati delivered a speech in the rain to army cadets, saying that salvation had finally come. The king believes that now is the time for his citizens to give up living off donor food from the international community and return to agricultural self-sufficiency:

“The time has come for us to come out of the dependency syndrome and start eating our own food that we have cultivated in our fields instead of depending on the donor community,”

Were it only so simple.

(more…)

Sphere: Related Content

As I

As I