Archive for the 'Investing' Category

Lance on Nov 08 2009 | Filed under: Economics, Investing, Lance's Page, Uncategorized

Employment as measured by the “establishment survey,” was down by 190,000; and Many feel it is an improvement that we are not falling as fast.

Well, let us take a moment to look under the hood of these numbers. First, while the establishment survey was down 190k, the number of unemployed soared by 558,000, to 15.7 million, as measured by the household survey. The establishment survey is taken from large businesses while the household survey calls individual households. It is the household survey that sets the unemployment rate. The establishment survey of companies doesn’t count the self-employed and undercounts employees of small businesses. So the economic picture is probably worse than the headlines when it comes to jobs.

(more…)

Sphere: Related Content

ChrisB on Jun 12 2009 | Filed under: Chris' Page, Investing

A Daring Trade Has Wall Street Seething from the Wall Street Journal. Amherst, a small Austin firm found a small loophole in the system. To use a crude metaphor, they sold the big banks hurrican insurance and then made sure the hurrican never came.

The burned banks include J.P. Morgan Chase & Co., Royal Bank of Scotland Group PLC and Bank of America Corp. Some banks have reached out to two industry trade groups about Amherst’s actions, and the groups are reviewing the transaction, according to people familiar with their thinking. “It’s all-out warfare” between the banks and Amherst, said a senior banker at one firm that lost money.

Really though, I imagine the big banks are mad that they didn’t think of it first.

Economics of Contempt has much more (and better) analysis here.

Sphere: Related Content

Lance on Mar 08 2009 | Filed under: Humor, Investing

Chicago Tea Party

ChrisB on Feb 19 2009 | Filed under: Chris' Page, Domestic Politics, Economics, Investing, housing, regulation, taxes

Rick Santelli just went off on Obama’s housing proposal live on CNBC from the commodities trading floor in Chicago.

It’s now the headline on Drudge:

VIDEO: ‘The government is promoting bad behavior… do we really want to subsidize the losers’ mortgages… This is America! How many of you people want to pay for your neighbor’s mortgage? President Obama are you listening? How about we all stop paying our mortgage! It’s a moral hazard’… MORE…

TRADERS REVOLT: CNBC HOST CALLS FOR NEW ‘TEA PARTY’; CHICAGO FLOOR MOCKS OBAMA PLAN

Who is John Galt?

Sphere: Related Content

Lance on Nov 17 2008 | Filed under: Economics, Investing, Lance's Page

The insufferable Peter Schiff has a video going around, which frankly, is just brilliant. He may be unpleasant at times, but he nailed this thing, and took mounds of abuse while doing so. More importantly, I KNOW HOW HE FEELS!

The resentment, irritation, condescension and, at times, outright hostility to my Cassandra act makes me wish I had a video of my own. Sigh…

Oh well, it pays to remember that Cassandra was right. I was never as sure of myself as Peter, but risk management isn’t about knowing you are right, but knowing what could go wrong and whether it is likely enough to act upon.

As an aside, Peter is no big government type, and he goes to prove that despite the media focusing on Roubini and others (who do deserve a lot of credit) that people across the ideological perspective warned of this. Thus having seen this coming is not the same as being correct about what to do about it, since those who saw the oncoming train differ markedly on that score.

Sphere: Related Content

Blaming Obama for the Market

Lee on Nov 07 2008 | Filed under: Domestic Politics, Election 2008, Investing

Ben Armbruster at ThinkProgress is upset Fred Barnes and Dick Morris are blaming Obama for the post-election declines in the stock market. Armbruster’s case is a little defensive and misjudged (he cites the New York Times’ opinion, as if that would mollify critics), but then the transition from implacable critic of a government to determined apologist for a proto-government has been swift for all at TP.

However, in a general way he does have a point to object on I think. People are out to make cash gains where and when they can in this market, and opportunities have been rather few lately. To the extent that there was a specific macro cause, it seems to me the abrupt election day rally was the more likely culprit for the subsequent sell-off. That is what we’ve seen in other isolated spikes on events this year. The Saturnian habit for feeding yourself by eating your children, rather than letting them grow up to sow the fields, if you will.

Although it should be said that Dick Morris’ point that provoked Armbruster’s ire is not entirely unreasonable either. There’s certainly some incentive for selling on a small gain now, if you expect capital gains taxes to be substantially higher later. Comprehensively rejecting that as a buried motive is not reasonable.

Sphere: Related Content

1948 After All

Lee on Nov 05 2008 | Filed under: Domestic Politics, Election 2008, Investing

Interesting:

[W]e are on pace for the worst reaction to an election since Truman won in 1948. Interestingly, the only times the DJIA has ever declined by more than 1% [are] the day after a presidential election when the Democratic Party won complete control.

(Bespoke)

Sphere: Related Content

Lance on Oct 14 2008 | Filed under: Economics, Investing, Lance's Page

I wonder if the juxtaposition of that headline and that photo was intentional?

Anyway, over at Risk and Return I follow up Dale, McQ and my discussion of the markets and the economy during the last couple of podcasts with some thoughts, observations and suggested readings on the investment climate we are in now. Lots of links, some enlightening graphics and views from those who saw this coming, including, ahem, me.

There are hopeful signs, but large risks. How cheap are stocks? What are the risks that remain? Will recent government moves help?

My own view is that some of it will, though it is not ideal, but possibly close enough for government work.

Let me know what you think in the comments here or via e-mail.

Sphere: Related Content

Stock and Awe in Baghdad

Lance on Oct 10 2008 | Filed under: Economics, Foreign affairs, Investing, Lance's Page

The Markets have spoken, the best place to invest in the world is…Iraq!

Now it’s stock and awe in Baghdad!

As the Dow plummeted nearly 700 points yesterday to fall well below the 9,000 mark, the Iraqi stock exchange – where this broker was merrily keeping up with her booming business – was flourishing, buoyed by four-year lows in violence and hopes of a reconstruction windfall.

Last month, Iraq’s general index went up nearly 40 percent, about the same percentage the Dow dropped over the past year. The jovial trading-floor mood is reminiscent of Wall Street’s bygone ‘greed is good’ era of the 1980s.

Sphere: Related Content

Strategery Capital Management LLC

Lance on Oct 02 2008 | Filed under: Economics, Humor, Investing, Lance's Page

The SEC doesn’t get the short end of the stick

Lance on Sep 29 2008 | Filed under: Investing, Lance's Page

If they did, then they wouldn’t have banned short selling. People may have noticed that the ban hasn’t helped, and today we see one of the real costs.

See, when markets collapse like today, short sellers dive into the market to cover their short positions, in these times they are often the only ones buying. They aren’t there today, and the market has lost one of its stabilizers.

Frankly, this whole affair has been drenched in idiocy.

Sphere: Related Content

Lance on Sep 18 2008 | Filed under: Domestic Politics, Economics, Investing, Lance's Page

The hedge fund industry is feeling gloomy, and so is Mayfair.

Meanwhile our government is considering following London’s lead and making their lives even more difficult, by banning short selling for a while. Yep, Fannie would have been just fine with mismatched liabilities, toxic assets and corrupt accounting mixed in with 40-1 leverage if nobody had been selling their stock, which is really all a short sale is.

This is crazy, and likely to lead to a much worse environment for both investing and the smooth functioning of capital markets, which are supposed to over time allocate capital. They are not supposed to lead to higher returns regardless of the worth of a company.

Wealth is not created out of thin air, it is supposed to be connected to the actual income stream a company can produce over time.

Market corrections are what keep wealth from being a product of a mere price we would like for assets, which is awfully disappointing to those who want wealth to be a casino where the house always loses, the drinks are free and the girls (or young men) always accommodating. (more…)

Sphere: Related Content

Uprecedented Financial Turmoil

Lance on Sep 17 2008 | Filed under: Economics, Investing, Lance's Page

Today the Fed went to the Treasury and asked for a line of credit. You know, the lender of last resort has had to turn to our Treasury to protect their balance sheet.

Want to see something weird. and look at the treasury market. In the bond world, a 1% move is huge. So check out what has happened in the US Treasury market. Especially the 13 week Treasury bill. It’s yield collapsed by over 97.67% today.

Astounding, truly astounding.

My father who invested (and very successfully) through the late sixties/early seventies nifty fifty era, the bear market of 72-74, the market low in 1981 and Black Monday in 1987 says this is the most incredible market in all of his experience. It certainly eclipses anything I have seen from 1980 forward.

Update: Courtesy of Eddie Elfenbein:

At one point today, the yield on the three-month Treasury bill (^IRX) hit 0.01%!!

One Freakin Bip!!

This means that the risk-free rate is now in direct competition with the underside of your mattress.

Sphere: Related Content

Are we in a recession yet?

Lance on Apr 07 2008 | Filed under: Economics, Investing, Lance's Page

Personally I think we have been negative since November. Given the large positive number in the third quarter, the barely above break even number in the fourth quarter virtually guarantees that the economy went negative sometime in November and December. However, if we are not, it is highly likely coming. Here is a graphic which should put it in perspective. From Moody’s we get this look at freight (Click to enlarge)

That is a pretty stunning collapse. Few things correlate with economic activity more than freight, and for rather obvious reasons.

While I have been very negative on the economy shorter term for some time, I will say I doubt this will be a particularly deep recession. On the other hand, I also expect it to be rather drawn out. Obviously I could easily be wrong on both counts.

I will repeat what I have said over and over, in a probabilistic world we cannot know the future, but we can say that the risks are rather high and we should all consider lowering the amount of risk we face. That means more cash in our savings accounts, more defense in your portfolios (if you are going to take risk, make it risk that doesn’t correlate with US financial markets) and reducing debt.

With both financial markets and housing prices I would be wary. Your situation may differ, but I keep hearing people say things must be attractive at this point. Housing is a much better deal than it was, etc.

That is exactly right, but I suspect that this also likely holds true. It is approximately 4 1/2 hours from Baton Rouge to Shreveport. Alexandria lies halfway between. When my children ask me how far we still have to go, while I undoubtedly have far less distance to go than when I started, I still have just as far to drive as I have already driven.

In many areas of the financial markets and housing things may be less expensive than they were, but they are still way too expensive and there is a lot more bad news coming down the pike.

Sphere: Related Content

Lance on Feb 25 2008 | Filed under: Domestic Politics, Economics, Investing, Lance's Page, regulation

Regular readers know that I have been harping on the likely collapse in housing since this blog began. At this point I am hardly an outlier in being concerned, which means now the politicians and experts are ready to ride to the rescue. Proposals to increase regulation, bailout mortgage insurers, banks and even homeowners are being floated. Alan Blinder wants to bring back the 1930’s era state owned mortgage business.

Most of these proposals ignore that the real problem isn’t falling prices, or non credit worthy borrowers, but that housing needs to fall in price in many areas. Thus plans to stabilize the housing market, and cost estimates assuming such a stabilization, are likely doomed to be disasters, not to mention how bad it would be if they were successful longer term. We may be buying an expensive method of merely stretching the pain out. The cure to this crisis is falling prices. Politicians however, don’t like the medicine.

Anyway, to catch up on all these proposals, the state of the market now, and various amusing aspects of this whole mess, I have a large roundup of links, observations, and plenty of visual data for the curious.

Sphere: Related Content

Lance on Feb 02 2008 | Filed under: Economics, Investing, Lance's Page

The Fourth quarter GDP numbers came in this week, and then the Fed went ahead and cut rates further. That is 125 basis points in about a week.!

I have a roundup of news, related opinion and other reactions at Risk and Return.

Sphere: Related Content

Lance on Jan 26 2008 | Filed under: Investing, Lance's Page

(cross posted at Risk and Return)

So, we now have a new record for trader fraudulently losing billions on bad trades. Nick Leeson will soon join the 1972 Dolphins as great, but behind by the numbers. Just like then I have a niggling thought in the back of my mind, and so does Adam at Adams Options:

So some trader at Societe General loses a cool $7 billion. The big question is why, I mean he was apparently in some salaried position.

Trying to impress his boss? Trying to impress our favorite French anchorwoman? Guess we’ll never know.

Sight unseen, these “rogue” losses are always the same. Trader makes bet, bet goes bad, trader fakes trades and doubles and doubles in order to make back the loss. Overseas blogger uses whole mess as excuse to post Melissa picture.

Make that two overseas bloggers.

What runs through my mind is this:

Finally it gets too big and the firm is forced to cover and come clean and produce some sort of bogus internal investigation to satisfy the authorities that it will never happen again.

It also makes you wonder how many times a trader goes through this cycle and is able to hold off long enough until the market moves in his direction and bails him out. Probably hundreds/thousands/millions of times for every one that comes to light.

With as much debt sloshing around as we have now, I suspect volatility will leave many of these guys in a position where it can’t be hid. Of course, most will be too small to actually hit the news. It is a risk however.

Sphere: Related Content

The Harley Report

Lance on Jan 25 2008 | Filed under: Economics, Investing

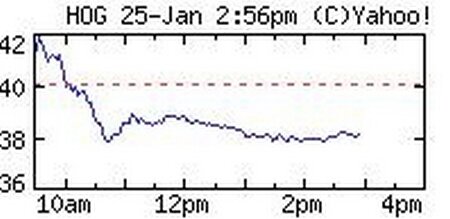

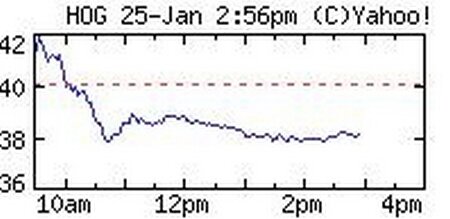

As I noted earlier, Dale Franks was curious about how Harley Davidson (HOG) would do on its latest earnings release:

As I noted earlier, Dale Franks was curious about how Harley Davidson (HOG) would do on its latest earnings release:

One earnings report to watch this week, though, is Harley-Davidson (HOG). It’s a solid company with a loyal customer base—I’m one of them actually—but, motorcycles are a luxury item. For every guy like me that rides practically every day, and uses a motorcycle as their primary transportation—there are about 10 guys that ride for maybe 2,000 miles a year. Or less. Those people are gonna stop riding—and buying—new motorcycles.

In fact, if the rumors are true, they already have, and Harley’s results for last quarter will be below analysts estimates. In the last year, Harley sold substantially fewer motorcycles than in 2006. Also, Harley’s stock has already lost about half of it’s value in the last year already, and disappointing earnings for last quarter won’t help.

The thing is, Harley is an interesting proxy for luxury buying. If Harley’s sales are looking bad on the 24th, when earnings are announced, that’s a pretty good indicator that consumers are shutting off buying non-essentials, a good indication of belt-tightening, and general economic cooling.

So what happened?

Revenue for the quarter was $1.39 billion compared to $1.50 billion in the year-ago quarter, a 7.7 percent decline. Net income for the quarter was $186.1 million compared to $252.4 million, down 26.3 percent versus the fourth quarter of 2006. Fourth quarter diluted earnings per share were $0.78, a 19.6 percent decrease compared to $0.97 in the fourth quarter of last year.

[...]

“Harley-Davidson managed through a weak U.S. economy during 2007,” said Jim Ziemer, Chief Executive Officer of Harley-Davidson, Inc. “As we announced in September, we reduced our wholesale motorcycle shipment plan for the fourth quarter, fulfilling our commitment to our dealers to ship fewer Harley-Davidson motorcycles than we expected our dealers worldwide to sell at retail during 2007,” said Ziemer.

[...]

Revenue from Harley-Davidson motorcycles was $1.12 billion, a decrease of $105.5 million or 8.6 percent versus the same period last year. Shipments of Harley-Davidson motorcycles totaled 81,206 units, a decrease of 11,642 units or 12.5 percent compared to last year’s fourth quarter.

[...]

U.S. retail sales of Harley-Davidson motorcycles decreased 14.2 percent for the quarter. The heavyweight motorcycle market in the U.S. decreased 9.0 percent for the same period.

[...]

For the full year of 2007, worldwide retail sales of Harley-Davidson motorcycles decreased 1.8 percent compared to the prior year. In the U.S., Harley-Davidson dealer retail sales decreased 6.2 percent for the full year; international retail sales increased by 13.7 percent. The U.S. heavyweight motorcycle market was down 5.0 percent for the full year of 2007.

To recap, miserable in the US, but offset to some degree by strong sales overseas. I think that meets Dale’s requirement for a bearish signal for the US economy. That was also at the low end of estimates. Yeah, it is getting whacked.

Thanks for visiting Risk and Return. Please feel free to contact us with any questions and/or comments. Please note our disclaimer.

Sphere: Related Content

The Global Correction

Lance on Jan 23 2008 | Filed under: Investing, Lance's Page

(Cross posted at Risk and Return)

This is a very cool look at the market carnage of the last few days geographically from the Wall Street Journal. You can go from one day to the next and watch how the markets in various places rose and fell*. Hat tip: James Hamilton (who has interesting observations on what happened.)

Click here for Global Correction

*Mouse over the cities on the maps to get the hard numbers.

Sphere: Related Content

Lance on Jan 23 2008 | Filed under: Economics, Election 2008, Investing, Lance's Page

Richard Rahn pushes for the indexing of capital gains due to inflation as part of the stimulus.

Accounting for inflation in this way has the advantages of producing more short-term revenue to the Treasury as long-term gains are “unlocked.” Furthermore, lowering the cost of capital would stimulate investment and the stock markets, and would increase the fairness of the tax system by not taxing phantom gains for people at all income levels. It would also square capital-gains taxation with the U.S. Constitution.

Assume you purchased a common stock in a company in 1984 for $100 a share and sold it in 2007 for $200 a share. Have you received any “income” from the sale of the shares of stock? The IRS would say “yes,” but this is clearly wrong. The IRS will claim that you had a $100 per share capital gain on the stock in the above example, yet actually the increase was solely a result of inflation. Because you cannot buy more goods and services with $200 now than you could have with $100 in 1984, you have had no “income” or wealth accretion.

Over the years numerous economists, lawyers and others have tried to fix this problem and have gotten nowhere with Congress. But now, due to increased concerns about inflation, economic growth and judicial salaries, the time may be right to move forward.

Pejman has his back.

Sphere: Related Content

Lance on Jan 22 2008 | Filed under: Economics, Investing, Lance's Page

From The New York Times:

WASHINGTON (AP) — The Federal Reserve, confronted with a global stock sell-off fanned by increased fears of a recession, cut a key interest rate by three-quarters of a percentage point on Tuesday.

Quicker and larger than expected. I am curious whether investors will, at the margin, consider this a move to celebrate or evidence that things will get much worse?

Sphere: Related Content

Lance on Jan 22 2008 | Filed under: Investing, Lance's Page

From the New York Times:

Heavy selling hit each Asian and European stock market as soon as it opened. Some of Asia’s easternmost exchanges, which had closed on Monday before the sharpest declines occurred in India and then Europe, suffered particularly steep drops.

The Japanese stock market dropped 5.7 percent, for the worst two-day loss in 17 years, while the Australian stock market tumbled 7.1 percent, its worst single-day loss in nearly two decades. The Shanghai market lost 7.2 percent while the Hang Seng index in Hong Kong plummeted 8.7 percent.

Sphere: Related Content

Today’s links: Washington tries to step up

Lance on Jan 18 2008 | Filed under: Domestic Politics, Economics, Investing, Lance's Page, regulation

(cross posted at Risk and Return)

Ben Bernanke gives Congress and the President the green light to take steps to stimulate the economy along with a warning:

(more…)

Sphere: Related Content

ChrisB and the Federal Reserve

Lance on Jan 18 2008 | Filed under: Domestic Politics, Economics, Investing, Lance's Page, regulation

Chris asked what he thought the Federal Reserve could have done differently. I gave him an answer, but there was more to be said. My full answer is here. Scroll around, there is a lot more on the what could have been done, what might be done, and the general risks which now surround our economy.

Sphere: Related Content

Lance on Jan 15 2008 | Filed under: Economics, Investing, Lance's Page

(cross posted at Risk and Return)

Paper Economy has taken a close look at what it will take to get inflation adjusted housing prices in Massachusetts back to trend over a five year period. It should be noted that for this to happen sooner the decline would have to be deeper (due to inflation doing less of the work for us.)

The following chart (click for much larger version) shows that in order to bring Massachusetts “real” home prices (as tracked by the OFHEO home price index for Massachusetts) in-line with the average annual return of 2.5% seen since the early 1970s, nominal prices have to complete a 16.8% decline (or 28.8% in “real” terms) from the latest peak.

(more…)

Sphere: Related Content

President’s and Markets

Lance on Jan 15 2008 | Filed under: Domestic Politics, Economics, Investing

Alea notices that a widely cited paper claiming that Democratic Presidents are better than Republican presidents for the stock market doesn’t hold water:

This paper shows that the statistical tests applied by the authors of the study were wrong, and that, once corrected, the difference in stock market returns under different presidential regimes is not meaningful.

The lessons of the paper extend well beyond the presidential effect and emphasize the importance of proper research design in carrying out statistical investigations.

(cross posted at Risk and Return)

Sphere: Related Content

My Next Project

Lance on Jan 11 2008 | Filed under: Baton Rouge, Economics, Investing, Lance's Page

We have a number of things in the works over the next few days here at A Second Hand Conjecture. We will let you know more over the next couple of days. I can only say I am extremely excited.

That is my picture, the scruffy 40+ year old, beer drinking, female ogling, punk/alt rock loving, irreverent blogger you have grown to despise, like, hate, love, etc. It was taken just after a pretty fun night (about 6 AM) in New Orleans with my wife.

That is my picture, the scruffy 40+ year old, beer drinking, female ogling, punk/alt rock loving, irreverent blogger you have grown to despise, like, hate, love, etc. It was taken just after a pretty fun night (about 6 AM) in New Orleans with my wife.

Now it is time to introduce my more professional side, the one in the suit. One of the things which has been a source of frustration since I began, is that there are a number of topics around which I have had to skate because of legal and regulatory issues surrounding my career. Those have now been largely removed and will allow me to discuss more fully issues which involve economics, finance and investing. Until you are a blogger or writer one doesn’t realize how many areas touch on that, and how it lead to all kinds of self censorship. Try discussing Social Security reform without discussing likely returns in the capital markets!

So expect a lot more from me in the coming months on these and associated topics. For those who do not know, I am the portfolio manager for Peters Wealth Advisors, a team of professionals located in Baton Rouge, La. Which leads to my next project.

I am now starting a new blog devoted to economics, finance and investing, as well as some discussion of news and events related to my hometown and my own interests. It will be part of the Forbes blog network which they are building. Some of the material will appear here as well, some I’ll let you know about, and some you’ll need to visit to see. I have a smattering of interesting stuff up already, though some of it has already appeared here. Comments aren’t enabled at this time except on the introductory post, though maybe they will be sometime down the road. Please feel free to leave comments here, at that post or e-mail me with suggestions, links, questions you would like to see addressed, whatever. I am looking for any feedback I can get to make the site a good one. I have the feed for the site over in the sidebar.

It will give you a chance to chide me, as we will be showing our investment results in general terms at the site. Of course you will have to wait for some future date, because when my review of the year and how things went goes up, you will find we had a fantastic year. In fact, our institutional portfolios were even up in the fourth quarter, and so far this year as well. We have been bearish, as regular readers I am sure divined when I did speak on these matters, even if indirectly, so we built the portfolios to do well regardless of the direction of the overall market. I still am bearish. If you want to know why, or even what I mean by bearish, well, keep on visiting.

I really want to thank everybody who has been visiting here and supporting the site, especially all of you who contribute to, or read, QandO, the site which brought most of us who started this thing together in the first place, Glenn Reynolds and his readers who have been generous in lending us their attention, and all the other bloggers who have supported us. The next year promises to be even better, with a great lineup of contributors here, and it is what I learned here that has allowed me to start this new project.

So please visit Risk and Return and let me know what you think and what you want in the future. Please visit the About Page for some background on what the sites philosophy is, and who I am. I guess my pseudo anonymity will now end, and I’ll need to update the “About Page” here as well.

Sphere: Related Content

Apple Reshapes Another Industry

Lance on Jan 11 2008 | Filed under: Economics, Investing, Lance's Page, Media, Technology

A fascinating look at the development of the iPhone and its impact upon the structure of the telecom industry. More than being a snazzy and popular device, the iPhone has changed how the relationship between players in the telecom industry works. There are long term economic, and yes, investment ramifications in this change.

Sphere: Related Content

The Housing Crisis

Lance on Dec 05 2007 | Filed under: Economics, Humor, Investing, Lance's Page

I think this explains it better than I have, at least it is more entertaining:

Technorati Tags: housing, investing, economics, hedge funds, mortgage debt, crisis, humor

Sphere: Related Content

The Google effect

Lance on Oct 14 2007 | Filed under: Economics, Investing, Lance's Page

Elise Ackerman gives us the rundown on the cascading effect of Google’s IPO and growth:

A Mercury News analysis of company documents filed with the Securities and Exchange Commission provides a rough estimate of the wealth that erupted from the famous search engine, spreading throughout the Bay Area and far beyond.

From 2004 through 2006, the most recent data available, Google generated more than $19 billion as employees cashed in stock options, top management sold shares and businesses provided Google with everything from imported olive oil to information technology services.

That’s more than the gross domestic product of countries like Iceland, Panama and Bahrain.

And the total Google effect could have exceeded $50 billion, thanks to the so-called multiplier effect, in which every dollar of spending theoretically creates two or three dollars more of economic activity.

Closer to home, the cash that stayed in Santa Clara, San Mateo, San Francisco and Alameda counties – where the bulk of Googlers live – couldn’t have come at a better time.

Googlers began getting their loot exactly as the rest of Santa Clara County – Silicon Valley’s epicenter – hit bottom after the dot-com bust.

Santa Clara’s labor force shrank to 840,700 – its lowest post-boom level – in April 2005, the same month the lockup that had prevented Google’s executives and employees from selling their shares after the IPO expired.

Google began minting millionaires at a time when a million-dollar paycheck had become something of a local rarity. The California Franchise Tax Board counted only 4,005 tax returns for Santa Clara households earning more than $1 million in 2005 – less than half the number reported five years earlier at the height of the boom.

H/T: Virginia Postrel

Sphere: Related Content

More Islamic Finance

Lance on Sep 04 2007 | Filed under: Investing, Lance's Page

Returning to an old subject we haven’t discussed in a while, I suggest this article on a couple of funds run by Islamic principles. Given the difficulties the financial sector is having a fund which avoids them (because they profit from interest) probably looks pretty attractive right now, especially given the funds stellar performance. I especially like this:

Are you seeing money coming in from non-Muslim investors who find the fund attractive?

Yes. Most of our money today is coming from RIAs and the supermarket platforms, those accounts that they’re managing, so the RIAs really are probably what’s driving most of our sales today, based on performance—I’m sure it’s what they’re after. And I think they’d like to know what they’re buying so we try to educate them so that they’re not surprised when they read the annual reports.

Performance chasers. I bet when they get the report they are surprised. It is sad how many advisors invest in funds they know nothing about except the shiny recent returns.

I’ll provide a clue. Despite the disclosure on everything that past performance doesn’t (predict/guarantee/whatever) future results most people in the financial services industry do not seem to believe it, or it has no effect on their behavior.

Technorati Tags: investing, mutual funds. Islam, Islamic finance, haram, interest

Sphere: Related Content

Living History

MichaelW on Aug 31 2007 | Filed under: Domestic Politics, Economics, History, Investing, Libertarianism, MichaelW's Page

Does the blogosphere make history more relevant? Is it possible that Santayana’s famous admonishment is made less likely by bloggers routinely wielding history as a foil to those arguments favoring actions proven desultory in the past? And that’s not to mention how blogs go about correcting historical inaccuracies trotted out by our betters. I can’t help but wonder about these questions, and the role of the blogosphere on the future, when so many lessons that I thought had been learned are tested once again.

In addition to that supremely failed experiment called communism, we also see attempted repeats of the Vietnam exodus and denials of the likely aftermath. Despite what history teaches us about all these events, some vow that this time will be different, or worse pretend that the past did not occur the way it actually did. Today bears witness to proposals which apprently ignore the wonderfully failed government intervention that brought us the S&L crisis from the 70’s and 80’s.

President Bush today plans to outline a number of proposals to stem the tide of mortgage defaults and help people hold on to their homes, a senior administration official said Thursday.

The program is the first detailed administration response to the housing-sector woes that have roiled financial markets worldwide since June, amid surging home loan delinquencies.

Included in the plan, according to the official, will be a proposal to expand the Federal Housing Administration’s ability to insure loans for people who have fallen behind on their payments and could be helped by refinancing.

The president also wants to raise the limit on the insurance premiums that the FHA can charge home buyers. That could allow the agency to insure a greater number of loans to high-risk borrowers.

In addition, Bush will propose temporarily suspending an Internal Revenue Service rule that makes a homeowner liable for taxes on any amount of mortgage debt that is forgiven by the lender, said the official, who requested anonymity because the president’s program hadn’t been formally unveiled.

The markets reacted predictably:

U.S. stocks rallied, led by bank shares, on President George W. Bush’s plan to curb mortgage defaults and stem losses in credit markets.

Countrywide Financial Corp., the nation’s largest mortgage lender, and Lehman Brothers Holdings Inc., the biggest underwriter of bonds backed by home loans, advanced after Bush said the government will help people with delinquent mortgages keep their homes. Dell Inc., the second-largest maker of personal computers, rose after posting profit and sales that beat analysts’ estimates.

Of course, that was just until Ben Bernanke said his own piece on the matter:

Stocks retreated from their highs after Federal Reserve Chairman Ben S. Bernanke said it is “not the responsibility” of policy makers to protect lenders and investors from the consequences of their financial decisions.

It’s like a globalized version of “good cop, bad cop.” Nevertheless, I find it curious that the moral hazard implicit in the S&L crisis is yet again being offered as a solution here. Indeed, there are great many similarities between the behaviors that led to the current subprime woes and the underlying conditions that brought about the S&L crisis (the primary difference being that high interest rates were an incentive then, while low interest rates were an incentive in the recent meltdown). In short, when the bad consequences of taking risks are minimized to the risk-taker, or insured for free by someone else, then we should expect to see more of the riskiy behavior. An even shorter version is, if you want more of something, the pay for it.

Will blogs bring once again wield history in a way that sheds light on why this is a bad idea. It is true that the blogosphere does not have a wonderful track record of success when it comes to changing behavior, but is it possible that by the constant and instantaneous reminders from the past will help avoid similarly bad decisions in the future? Hopefully, these questions and others will find some answers in the near term. Our current leaders could use a healthy dose of history.

Technorati Tags: history, blogosphere, S&L crisis, subprime mortgages

Sphere: Related Content

Regulation and disclosure often destroys information

Lance on Aug 23 2007 | Filed under: Economics, Investing, Lance's Page, regulation

From Robert Lawson:

I hopped on the Chipotle website the other day looking for nutritional information on my favorite meal (carnitas burrito, rice, black beans, mild, hot, and green salsa, lettuce). But thanks to the nanny state, THEY CAN’T TELL ME!.

Unfortunately, for the time being Chipotle can no longer publicly post calorie and nutritional information on our website, due to a regulation recently enacted by the New York City Department of Health. This regulation states that if a restaurant posts calorie information online, it must also post that information on the menu boards of its New York City Restaurants. Unfortunately, as written, this regulation would require us to post (using the same size type as is on the menu) the calorie information for every possible burrito, taco, and burrito bowl configuration. As you can imagine, there are thousands and thousands of possible combinations, making it impossible to post this information in our New York City restaurants.

This kind of thing happens in many places. Take the plight of customers at a brokerage house wanting information on an IPO. They call up the broker who offers to send them a prospectus. The prospectus is 256 pages long and the customer will not read the whole thing, and if he did it is so filled with legalese that he wouldn’t understand it or pull the relevant information from it anyway. That is also true for all but a tiny percentage of brokers or advisor’s who work with the public. The broker could highlight or in some other fashion point to the relevant information in the 256 pages. That though is illegal, they cannot put sticky notes or anything. The broker has a short summary of three or more pages which pulls all the most relevant information for the client to know so the broker can discuss it intelligently. These can be quite informative. Unfortunately the broker cannot give or even show this to the customer as they are only allowed to give them the actual prospectus, which the client will not read.

All of these restrictions have legitimate rationale’s designed to curb actual abuses.

So what is the upshot? The client basically is at the mercy of whatever the broker says, with no reasonable way to check it or whether the broker is representing the materials he has accurately. Each individual restriction discourages a real issue, but as a whole it leaves the customer with less useful information and more exposed to the manipulations of bad actors. It also leaves the broker who prefers to document all of the information he gives a client no way to do that which relies on anything but his word (such as contemporary notes.) Actually handing a client a short, bulleted document that can be referenced which contains his basis for discussion could protect him or her as well.

Technorati Tags: IPO, regulation, Chipotle, New York, information

Sphere: Related Content

The reassertion of the risk premium

Lance on Aug 15 2007 | Filed under: Economics, Investing, Lance's Page

One of the sure signs that problems are a pretty likely outcome is when risk is priced at levels which are unlikely to pay enough to adequately reward investors over time. When the world gets a bit too complacent, conditions seem perfect and volatility is low, we tend to project that into the future. Thus, as Hyman Minsky (scroll down to A Minsky Review) pointed out, stability leads to instability. If a car seems safer, we tend to drive faster. If risk in financial markets doesn’t present itself for a while, we pile it on until it causes the stability to become unstable. This is true in a number of areas outside of finance as well, but it is asserting itself with a vengeance in finance right now.

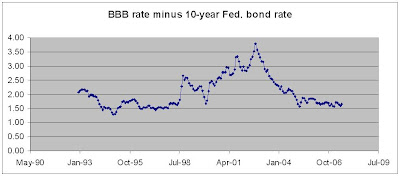

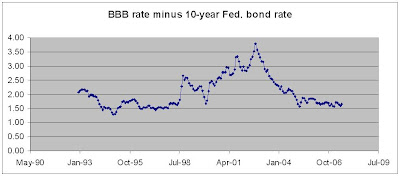

So I am over at Angry Bear and notice this from PGL:

Could I ask one favor from James Pethokoukis – stop emailing me stupid stuff like this:

For a more upbeat take, here is another of my favorite guys, Don Luskin of TrendMacrolytics:

The price of risk in credit markets has returned to normal levels, but for those who gorged for years on a zero price of risk, it feels like whiplash.

It’s bad enough that you cite the Stupid Man Alive on any economic issue. When Luskin says “the price of risk” is zero, what is he babbling about?

Now, I tend to disagree on the likely fate of financial markets with Don, but frankly I have to agree with him here. PGL justifies his incredulity with this little graphic:

So what is a normal level for something like a credit spread and has this spread been zero recently? Well, let’s look at the difference between interest rates on BBB rated corporate bonds and the ten-year Federal bond rate as a proxy for this idea (if Luskin has a better measure, it’s a shame he failed to mention it). It would seem that this credit spread has not been zero for the past several years. In fact, it was higher in 2002 and 2003 than it is today. So when Donald Luskin

claims people have “gorged for years on a zero price of risk” – he has no idea what he is talking about.

Frankly, I have no idea why PGL is going on about this at all, other than he despises Don Luskin, because that isn’t how you look at it. Plenty of people have noted exactly what Luskin is saying. Luckily I don’t have to go find an explanation that sounds coherent, because Don found one for me, from Bill Gross (essential reading by the way, most successful bond manager in the world and a decent writer to boot.)

…high yield spreads dropped to the point of Treasuries + 250 basis points or LIBOR + 200. Readers can sense the severity of the diet relative to risk by simply researching historical annual high yield default rates (5%), multiplying that by loss of principal in bankruptcy (60%), and coming up with an expected loss of

3% over the life of future loans. At LIBOR + 250 in other words, high yield lenders were giving away money! [emphasis in orginal]

For those who don’t want to do the math, about 50 basis points. Of course, unlike Don, I view the risk premium as pretty much non-existent throughout most of the market and across most asset and sub asset classes, but if you can’t give credit to those you disagree with when they are agreeing with you, well, when can you? PGL knows better, he knows spreads have been too low. He doesn’t have a fundamental issue with Luskin even if he thought Luskin was using a bit of hyperbole and wasn’t referring to expected loss compared to the spread, but just felt they were too low. To put it another way, if the same comment had come from, well, Angry Bear, or Bill Gross, he wouldn’t have raised a peep. Politics has fried just about everybody’s brain.

Technorati Tags: Economics, finance, risk premium, risk

Powered by ScribeFire.

Sphere: Related Content

Pity Poor Wall Street

Lance on Aug 10 2007 | Filed under: Domestic Politics, Economics, Investing, Lance's Page

Mickey Kaus gets it right:

“My people have been in this game for 25 years . . . They are losing their jobs”: I thought Wall Streeters were paid big money because they took big risks. Capitalism, etc. But when those risks actually materialize, and the Wall Streeters are actually threatened with large losses that might change their lifestyles, Jim Cramer shows up . …

Sphere: Related Content

Are Hedge Funds Worth It?

Lance on May 24 2007 | Filed under: Investing, Lance's Page

Dave Leonhardt asks the question in the New York Times:

Last year, the Standard & Poor’s 500-stock index jumped 14 percent, while the average hedge fund returned less than 13 percent, after investment fees, according to Hedge Fund Research in Chicago…Since 2000, the average hedge fund hasn’t done any better, after fees, than the market as a whole, according to research by David A. Hsieh, a finance professor at Duke.

There is much more of interest in the article, but for most investors (who qualify) are they worth it?

Tyler Cowen gives his thoughts:

My guess is that a small number of very bright individuals can in fact beat the market on a systematic basis. Today the world can mobilize enough capital so that these people become very very rich and have a larger impact on market prices than in times past. These individuals also spawn overconfident imitators, which lead to subnormal returns for the non-superstars. On average the gains and losses are a wash, but the true stars must limit the amount of capital they manage, for fear of pushing around market prices too much. Some set of insiders thus continue to gain wealth whereas most outsiders are playing the usual efficient markets game, with slightly subpar returns, due to the informed trading of the insiders. The geniuses are in effect taxing the uninformed trading of the non-genuises, but I do not see the trading volume of the latter group falling in response.

Maybe so, but as an asset allocation decision neither Tyler or Mr. Leonhardt address the real issues.

First, about the statistics addressed above. I have no idea where he gets his data from, but professor Hsieh is comparing apples to oranges. Hedge funds comprise a rather diverse group of strategies that are not necessarily expected to beat the S&P500. The data is quite likely incomplete as well. In addition, comparing a period when hedge fund returns have been relatively low may not be particularly meaningful. If the S&P500 were to decline even 15% over the next year, hedge funds would have a rather large lead. Finally, hedge funds are far less volatile as a whole, thus as risk control vehicles even approximating the returns of the S&P500 makes them look rather attractive.

We also have a definitional problem. Given that the term hedge fund has basically become a name for the legal and compensation structure, rather than approach, hedge funds should be judged relative to the purposes they are used for, not against the S&P500 or any particular benchmark.

The final issue centers around how they are used. Many absolute return oriented funds are used as bond replacements and as a diversifier. Thus they may raise a portfolio’s return while improving its risk characteristics even if they underperform for a period the S&P500. Others may serve various purposes in a portfolio. Especially if one feels the market is unlikely to perform well over a particular time frame, and that the risk/reward ratio is unattractive in equities, it may make sense to allocate more to hedged vehicles (whether they are hedge funds or not) just as one might allocate more to bonds or cash. Hedge funds are about making money, not beating the S&P500 over any discrete period of time, especially on the upside (even as tepid an upside as we have seen since 2002.)

As one wise man once told me, “I’ll take a mediocre manager who is making money during times when great ones are losing their shirt any day. I don’t care if the great one is beating his benchmark, because my benchmark is making money and not losing it.” Or as one of the greatest hedge fund mangers of all time, Warren Buffett, once said on investing:

The first rule is not to lose. The second rule is not to forget the first rule.

Sphere: Related Content

Sunny Times for Chinese Solar Power?

Lance on May 13 2007 | Filed under: Environment, Investing, Lance's Page, Technology

To get rich is glorious in China nowadays. Scientists are no exception.

To get rich is glorious in China nowadays. Scientists are no exception.

A top home-grown inventor, 41-year-old Ma Xin, is currently engineering a reverse takeover of a small Singapore-listed investment company, Rowsley, in a deal worth 2.7 billion Singapore dollars ($1.6 billion) that would bring a small part of his high-tech corporate empire, Sinocome Group, to the international capital markets.

Ma is conducting the takeover through an obscure solar panel production company called Perfect Field that he founded last year.

Outside of the attempt to tap into the international capital markets, why is this interesting?

(more…)

Sphere: Related Content

The heir to the throne

Lance on May 09 2007 | Filed under: Domestic Politics, Investing, Lance's Page

Of the major candidates for President, John Edwards is my least favorite. Why? Take his latest move showing empathy with the poor. He worked as a consultant to a hedge fund for a year to cool his heels before launching his next presidential campaign. Perfectly good job, and like Edwards, I would have found it fascinating. Not to mention, hedge funds pay very well. Can Edwards just say that? No, he can’t:

Of the major candidates for President, John Edwards is my least favorite. Why? Take his latest move showing empathy with the poor. He worked as a consultant to a hedge fund for a year to cool his heels before launching his next presidential campaign. Perfectly good job, and like Edwards, I would have found it fascinating. Not to mention, hedge funds pay very well. Can Edwards just say that? No, he can’t:

WASHINGTON — Democrat John Edwards said Tuesday he worked for a hedge fund between presidential campaigns to learn about financial markets and their relationship to poverty — and to make money, too.

In an interview with The Associated Press, the former North Carolina senator said his yearlong, part-time position with Fortress Investment Group helped his understanding of the connection, but he has more to learn.

Edwards has made eradicating poverty a focus of his second White House bid.

Edwards, a multimillionaire after years as a trial lawyer, would not disclose how much he got paid for a year of consulting beginning in October 2005. He said the amount will be revealed when he releases his financial disclosure forms due May 15.

Asked if he had to join a hedge fund to learn about financial markets, Edwards replied, “How else would I have done it?”

He said he considered going to an investment firm such as Goldman Sachs, but Fortress was the most natural fit. Presented with the suggestion that he could have taken a university class instead, he said, “That’s true.”

“It was primarily to learn, but making money was a good thing, too,” the 2004 vice presidential nominee said in an hourlong interview with AP reporters and editors.

I think I am going to be sick. Luckily Tom Maguire chose being clever instead:

(more…)

Sphere: Related Content

Old news to haunt Hillary?

Lance on May 01 2007 | Filed under: Domestic Politics, Investing, Lance's Page, Media

I can’t tell you what will come of this, or if it should really matter any more, but Carl Bernstein is publishing a book about Hillary that is promised to shed light on a number of controversies and Hillary’s less than forthcoming and deceptive explanations for them.

Drawing on a trove of private papers from Hillary Clinton’s best friend, the legendary Watergate journalist Carl Bernstein is to publish a hard-hitting and intimate portrait of the 2008 presidential candidate, which will reveal a number of “discrepancies†in her official story.

“Bernstein reaches conclusions that stand in opposition to what Senator Clinton has said in the past and has written in the past,†said Paul Bogaards, a spokesman for Knopf, which publishes the book on June 19.

With the thoroughness for which he is famous, Bernstein spoke to more than 200 of Clinton’s friends, colleagues and adversaries. He stops short of accusing the New York senator of blatantly lying about her past, but has unearthed examples of where she has played fast and loose with the facts about her “personal and political lifeâ€, according to Knopf.

You can read the rest, and I am not all that concerned that she has not been honest about many things. Given the amount of time, privacy concerns and all the other pressures upon our leaders, that is going to happen, call me cynical, but also realistic. (more…)

Sphere: Related Content

News Brief, Harrowdown Hill Edition

Joshua Foust on Apr 24 2007 | Filed under: Domestic Politics, Economics, Foreign affairs, Investing, Military Matters, social science

Cross-posted at The Conjecturer.

The Pentagon

- James Clapper, the UnderSecDef for Intel, wants the TALON database scrapped. This is because it recorded not just legitimate threats to U.S. bases, but information on civilian protests and anti-war marches. In other words, it had morphed into a tool for the abuse of power, and Clapper is right to want it gone. And dammit all to hell if Noah Shachtman keeps posting things before I can get home and do the same.

-

Inside the Navy hints that something is going to come of a Justice investigation into the Coast Guard’s Deep Water program, a joint venture between Lockheed Martin and Northrop Grumman. Naturally, the program features budget shenanigans, bad design, and sloppy management.

- It’s official: President Bush is worse than Lyndon Johnson, according to the Pentagon’s comptroller (big pdf). In 2008 dollars, Johnson spent $2.1 trillion between ‘64 and ‘68 on an active force of 500,000 men in Vietnam and an active force of an additional 3.5 million men and women, while Bush has spent $2.5 trillion between ‘04 and ‘08 on 140,000 combat troops and 1.5 million personnel on active duty. We also learn exciting Pentagon Math, like deciding to buy fewer planes we don’t need for more money than we wanted. War is expensive, but that hasn’t calmed our appetite for it.

- It was also shocking to see Jessica Lynch, while testifying in a hearing about the lies the Army told about the friendly fire death of Pat Tillman, accuse the military of . From a woman who was exalted as a selfless hero, this beggars belief, but we owe her a tremendous debt, for her service, and for standing up and telling the truth.

Around the World

- The UN Refugee Lady is going on a tour of Central Asia. I say: what a lame idea.

- In their clever “Six Degrees of Honorary Degrees,†Foreign Policy tries to show… something… about how President Bush has given speeches at mainstream and Ivy League schools that have also hosted speakers who have spoken at other universities where bad people have spoken too. Just like Kevin Bacon! The “most unsavory†leaders they link him to are Hugo Chavez, Fidel Castro, Saddam Hussein, Mohammed Khatami, Muammar al-Qaddafi, Robert Mugabe, and… Benazir Bhutto. Natch.

- Russia is staying focused on its goal of energy “cooperation†with Turkmenistan, while Kazakhstan seems keen on constructing a non-Russian gas route. And where is the United States? Umm… I don’t know, Iraq?

- A chilling look at the violent racism of South Korea. Is that why they assumed we would rise up in an orgy of race-hatred after the Tech massacre? Related thoughts at OFK. It’s interesting that the South Koreans instantly assumed race would be a factor. But I thought the USA was the most racist country on earth?

- North Korea also apparently uses

Burma Myanmar to smuggle its heroin. Like they want to be Afghanistan?

- Turkish Prime Minister Recep Tayyip Erdogan will not run for President… because the public worries he is not secular enough. This is something to celebrate, it really is. Now to repeat the trick here…

- Ever ready to assist the hundreds of thousands fleeing in terror, Ethiopia has taken to barraging Mogadishu with tank fire.

- Plus, everything you think you know about Darfur is wrong.

- Pervez Musharraf says the fighting in Waziristan is all a part of his master plan to end terrorism, tribalism, and unite the country. Excuse me, I just coughed.

- This tale of how years of an ineffective eradication campaign in Colombia have highlighted impotent American foreign policy is instructive for Afghanistan, since we just took our ambassador from Bogota and sent him to Kabul, where interdiction and eradication is on the lips of every American commander you can talk to. Small wonder Afghanistan’s opium crop seems to only grow larger by the year.

- Syria’s ambassador to the U.S. has learned a lesson we all must learn at some point: your job will eat into your blogging schedule. It is a rite of passage, like getting pimples, or the clap.

- A self-taught Mongolian yak herdsman has won the Goldman Environmental Prize for his herculean efforts to stem the environmental impact of the local mining companies. Maybe we could learn a thing or two from him. Pictures here, hat tip Ms. Bonnie.

- Boris Yeltsin, R.I.P. You made it at Russia.

Back at Home

- Sheryl Crow, in the midst of her three-tractor trailer, four-bus, six-car tour, got it into her head that we should all use less toilet paper. The moment she practices an ounce of restraint in her own life, I’ll listen to her. Buying indulgences from the Holy Environment Council so doesn’t count.

- Camille Paglia blames the Tech Massacre on the forces that are feminizing men in our society. Because feminized men are more prone to murder?

- In case you needed more evidence that you simply cannot comprehend the lives of the elite in our society, here’s James Simons, the manager of a successful hedge fund. He earned $1.7 billion last year.

- AT&T has discovered that hating its customers and showing contempt for anti-trust laws and consumers is actually quite profitable.

- I’m somewhat embarrassed to say that as a supposed member of “Generation Y,†I, too, have fallen for the marketing of these fifteen brands.

Sphere: Related Content

A BRIC Through Our Window? The Global War for Capital

Lance on Apr 15 2007 | Filed under: Developmental economics, Domestic Politics, Economics, Foreign affairs, Investing, Libertarianism

According to BRIC Consulting, by the year 2040 The BRIC Countries (Brazil, Russia, India, China) will have surpassed the combined GDP of the G-6 (US, UK, Italy, France, Germany, Japan) as of the year 2050:

The US will of course do rather well according to this study, especially on a per capita basis:

Massive populations plus growing economies seems to make this outcome virtually assured. Myself I welcome it, because this implies a world of relative stability, a world where trade and commerce are more important than ideological conflicts.

Some view this with trepidation:

(more…)

Sphere: Related Content

The Price of Economic Stability

Lance on Apr 03 2007 | Filed under: Economics, Investing, Lance's Page

One of the real points of contention amongst those concerned with economic policy is the increased stability of economic growth and why it has occurred. It is also an area of real concern for investors, for economic stability has some interesting affects. My interpretation:

- Increased stability leads to less risk aversion, thus an increase in valuation levels and declining yields. That is very profitable for those holding financial assets as stability increases (see 1981-2000.)

- This affect is only temporary. The reduction in risk premiums and increases in valuation cannot go on forever. Once a new valuation range is set, long range returns on equities and other assets are actually reduced. While growth may be similar in aggregate, yields are lower*. We have seen that affect in recent years. Even the eqyuity rally post 2002 has been unusually stable, and featuring unusually low returns for an upswing.

-

Minsky’s revenge! (pdf.) With a more stable world we take more risk, thus eventually leading to instability. Build me a safer car and I drive faster and less cautiously. When that percieved lack of risk is unusually profitable as point number 1 is occuring, the assumption of risk by economic actors can be exceedingly high. Think tech bubble or housing in California and other high flying locales more recently. Debt (or leverage) increases dramatically. Stability leads to instability.

- This tendency toward instability does not erase all the gains of stability we see, but the loss is not insubstantial.

So is the increasing stability a long term feature or will Minsky not only be correct, but all the stability gains will unravel in the face of hubris and human error? One potential clue comes from Milton Friedman. Alex Tabarrok weighs in with this graph:

In one of Milton Friedman’s last papers (circa 2006) is this stunning graph.The graph shows the standard deviation of real output and money (M2) from 1879 to 2005. The sharp break in the series around the late 1970s and early 1980s is evident – the standard deviation of money fell dramatically and so did the standard deviation of output.

Money is partially endogenous so one could interpret this as running from output to money. The rapidity of the break, however, suggests otherwise. It’s easy to understand how policy could quickly have made money growth more stable. It’s much more difficult to understand how or why real output could quickly become more stable. Moreover, the fact that money stabilized as Volcker and then Greenspan headed the Fed is also suggestive of monetary policy as the driving force.

In one way this is a testament to better monetary policy beginning circa Volcker but in another it’s a damning indictment of how poor monetary policy has been over most of the history of the Federal Reserve.

Obviously with money being stable, growth is more stable. While this might increase risk taking, I would guess the risk to investors is still lower. Human error still exists as a source of instability, but as we have seen since 2000 those errors (and shocks such as 9/11), when not complicated by unstable monetary policies don’t result in the kind of dramatic instability in output that we saw in previous years.

We should also recognize that the transition to a service based economy has been part of the equation, as well as the improved logistical management of our business sector.

(more…)

Sphere: Related Content

Trying to smoke out “Big MO”

Lance on Mar 13 2007 | Filed under: Domestic Politics, Economics, Investing, Lance's Page, Law, Libertarianism, Media

I may surprise some of you, but I am generally not fan of regulation. … What? No gasps of incredulity?

So why? Too many reasons to count, but I’ll suggest this is a good example of one of them. Thus I will steal an entire post from jk at Three Sources:

…………………………………………………………………………………………………………………………………..

The Democrats are in charge and have decided that the FDA (my personal bete noire) should regulate tobacco. So, how have those shorts on tobacco panned out?

Terrible. As Adam Smith told us in 1776, businesses don’t want freedom and a level playing field. They, like incumbent politicians, want protection from innovation and competition. Morgan Stanley and Citigroup analyses both tout the positive effects of the bill on big tobacco’s share value. Citigroup says “We believe the results” of regulation “would actually help the major cigarette manufacturers since it would entrench their position further allowing them to maintain market share or increase it.”

This is from a Wall Street Journal editorial (paid link) that enumerates the advantages to entrenched providers:

First, the Kennedy bill (co-sponsored by Texas Republican John Cornyn) specifically prohibits the FDA from banning tobacco products, so some in the industry feel this gives the Marlboro Man and the Camel brand a new lease on life. Second, the call for new advertising restrictions “clearly protects the dominant name-recognized brands,” according to Dr. Gilbert Ross, a tobacco specialist at the American Council on Science and Health. Ad restrictions would help Philip Morris freeze in place its 51% of the cigarette market.

Third, the bill would prevent the smokeless tobacco industry from claiming that it is safer than cigarettes, as if they are equally dangerous. The big cigarette makers figure that this will reduce the appeal of smokeless products that are the biggest competitive threat to cigarettes. Never mind that a large share of addicted smokers get sick or die from smoking, while the figure is 1% for users of smokeless tobacco.

Everybody wins, huh? I’m going back to bed now…

……………………………………………………………………………………………………………………………………

This is nothing new as either behavior or analysis. Back when I worked at one of the firms cited above, and being one of the few who actually read the strategist and analyst reports carefully, I am familiar with the argument. The analysts consistently pointed out that the regulatory efforts of the state, including sin taxes, generally helped the major brands and explained the willingness of “Big MO” to go along with, and even encourage, regulation. They do just enough complaining to keep those interested in striking a blow against the greedy, death dealing, capitalists feeling morally righteous while in fact welcoming advertising restrictions and other methods of widening the restrictions to include smaller competitors. All in the name of public health.

Technorati Tags: cigarettes, tobacco, stock, FDA, Democrats

Sphere: Related Content

Will We See the Efficient Market Hypothesis at Work?

MichaelW on Feb 20 2007 | Filed under: Domestic Politics, Economics, Investing, Law, MichaelW's Page

As the “Scooter” Libby trial draws to a close, speculation abounds as to the final outcome. According to Chicago Boyz (HT: Insty), the Intrade betting market sets the chances of Libby being convicted at around 70% for.

Despite wishful thinking by some conservative pundits, the odds that Libby will be convicted, as reflected by the Intrade betting market, have been creeping up and are now around 70%. The bigger question at this point is whether President Bush will have the balls to pardon him.

Because I’ve been following the trial fairly closely (although, not as obsessively as some), those odds struck me as ridiculously high. Particularly when you have a jury case, in which you really can’t ever tell what will happen until the verdict if finally read. The odds on a specific verdict in a jury trial shouldn’t ever leave the bounds of 60/40 for or against. In this case, they should be hovering around 50/50.

Why? Well, as I said, I have been following the case the entire time, and I’ve read a great deal about the prosecution’s case, the defense’s story, and the confusing menagerie of witness statements. (If you are not up to speed, I suggest Tom Maguire’s analysis to get you there.) Based on what I’ve read and seen, I am at a loss as to how the jury could find Libby guilty, when so many of the witnesses against him made similar (if not more egregious) mistakes in recounting what they knew, when they knew it, how they knew it, and whom they told. But that’s just me. What if I wasn’t so well-read on the topic? What would be my assessment of Libby’s guilt or innocence? I think Christopher Fotos (of Post Watch Blog), put it best:

I wonder to what extent the traders get their information about the trial from Dreaded Mainstream Media. I mean heck, the jury could convict, I have no idea. But when you compare mainstream reporting with what’s come out on some Plamaniac sites like Tom Maguire’s Just One Minute, you get a radically different view of what’s come into evidence, the performance of various witnesses, etc. Do most traders know that a previously unknown FBI interview with Tim Russert credits him with saying,in contradiction to his testimony, that he couldn’t rule out that Valerie Plame came up in his conversation with Libby?–a conversation that is a keystone to Fitzgerald’s case? I could provide several more significant examples like that. My point isn’t to argue the case here–I just wonder about the source of their impressions.

Is there a case of asymmetrical information going on here? Could it be that incomplete and possibly incorrect information is dominating the futures market on the Libby verdict? If so, then there should be a chance to make a killing on this deal for those who have better information.

Of course, maybe the odds are dead-on, as they usually are for predicting elections. But I don’t think so. For one thing, in elections, those making the bids are likely also voters, or at least enough of them are to be capable of bringing real information to the market. For the Libby trial market, there are only twelve people who get to vote, and even if every one of them placed a bid (without anyone else finding out) they likely wouldn’t bring enough info to move the market one way or the other. Another reason I think that the futures market is wrong, is because there is a lot of gut-feel speculation going on with respect to the outcome, as opposed to informed price-setting. People may be betting on what a guilty verdict is worth to them, but that doesn’t necessarily mean that they are informing the market of the actual outcome. In other words, I think what we are seeing here is irrational exuberance inflating a Libby trial bubble that is about to burst, dousing the hopes and dreams of a number of anti-Administration investors.

That’s just my opinion, you make the call.

Technorati Tags: Scooter Libby, Valerie Plame, Joe Wilson, futures market, Intrade, efficient markets hypothesis, EMH, market making

Sphere: Related Content

Spend More, Tax More (for Democrats business as usual)

Keith_Indy on Jan 16 2007 | Filed under: Domestic Politics, Economics, Investing, Keith's Page

Michael said the other day:

Even so, it’s getting harder and harder for Democrats to lay any fiscal irresponsibility at the feet of tax cuts, when such cuts are at least partially responsible for the increased revenues, and federal spending continues to grow, albeit at a slower rate. Ratchet down the spending side (sharply) and we should begin to take chunks out of the overall debt.

That’s not going to stop them from making the rhetorical and highly emotional argument that the rich don’t pay their “FAIR SHARE.”

Yes, wouldn’t it be nice if the Democrats actually cut spending, without leaving free Iraqis hanging in the balance or gutting the defense department. Well, something tells me, even if the Democrats got us out of Iraq completely, government spending would still increase.

And the Democrats are also on track for increasing taxes as well. What did they do first, they changed the rules to give themselves more power to raise taxes.

Beginning of the End

On Thursday, the House of Representatives will vote on legislation to increase taxes for the first time since 1993. It took just 15 days of new found power for the Democrats to raise taxes. The first vote of the 110th Congress removed the 3/5 supermajority to raise taxes. The following day was a vote to enact a new rule requiring offsetting tax increases for every tax cut.

But hey, the Democrats aren’t known as the Tax and Spend Party for nothing…

I mean, what was everyone expecting when they voted for the Democrats (or for some, voted against the Republicans.) That the tiger would shed its stripes and become a tame house-cat, only overturning the worst excesses of the Republicans but otherwise being benign?

Well, you get what you pay for, and in this case, you get what voted for. Of course, the big problem is, I get what you voted for to, which is certainly not what I wanted. Oh well, that’s what happens when you live in a Federal Republic with power and money hungry people being the only ones (mostly) that have the resources to be elected.

Well, at least we’ve got at least half a year to figure out how to minimize the impact to our personal pocket books. Of course, raising taxes, and the minimum wage is likely to sabotage our economy, which, of course, the Democrats will want to “fix” with more government intervention. So, get ready for a rocky ride in the next few years.

Sphere: Related Content

Real Estate and the Dems

The Poet Omar on Jan 11 2007 | Filed under: Domestic Politics, Economics, Investing, The Poet Omar's Page

is an interesting take on the new Dem Congress from Real Estate Broker and “The Apprentice 3″ winner, Kendra Todd. I’m hardly an expert on matters of real estate speculation, but I’d like to examine this brief articles contentions in a bit more detail.

(more…)

Sphere: Related Content

Listening Notes: Capital Keeps Raining On My Head

Lance on Dec 22 2006 | Filed under: Economics, Humor, Investing, Lance's Page, Music

Yields are low throughout the world, and despite the rising equity markets low yields on equities mean low long run returns on them as well as bonds. So we may actually be facing an end to the decade characterized by growth punctuated by either choppy to low returns on financial assets or a massive bubble as the economy stays relatively stable and people extrapolate that in a search for return that drives long run returns even lower. If that happens watch your wallet as yields climb and asset values fall upon deflation of the bubble. My guess? Choppy returns with a couple of 2000-2003 like collapses in various segments of the asset markets every time the economy slows as assets move unevenly to more normal valuation levels. Why are yields low on financial assets? Excess liquidity which is positive for growth, but negative for long term investment returns is one theory (while growth is good due to a low cost of capital, the high valuations drive down the yield per dollar actually invested.)

If true watch risk carefully! This is not the time to be reaching for yield or Goldilocks scenario returns even if growth is solid.

The thesis that it is the monetization of an aging western population’s assets that is providing this excess liquidity is held by Sam Zell amongst many others.

Oh, this is a listening note, which is supposed to be about music. And so it is, here is Sam Zell. (Click on the Theory of Relativity icon)

Hat tip: Greg Mankiw. (more…)

Sphere: Related Content

The Politics of Investments

Lance on Nov 09 2006 | Filed under: Domestic Politics, Economics, Investing, Lance's Page

Slate has pointed me towards information that we have never before had access to on the political class. The Center For Responsible Politics has been crunching the financial disclosure forms of our dear leaders. One interesting aspect to me (go figure) was the composition of the assets in their portfolios:

The nonpartisan Center for Responsive Politics recently performed the Herculean task of determining which members of Congress own what stocks. Its reports, which you can browse here, are an enthralling psychofinancial portrait of political America. For example, it turns out that oil giants BP and ExxonMobil as well as tobacco/food company Altria are overwhelmingly favored by Republicans, while Democrats are heavily into tech stocks such as Sun Microsystems, Texas Instruments, and Vodafone, the British-based mobile-phone giant.

People can make of that what they will. My only comment is that the Republicans are likely to do much better in terms of their portfolio’s over the next several years than the Democrats if these investment preferences hold up.

Technorati Tags: Investing, Republicans, Democrats, Center for Responsive Politics

powered by performancing firefox

Sphere: Related Content

A Positively Crazy Idea

MichaelW on Oct 11 2006 | Filed under: Economics, Foreign affairs, Investing, MichaelW's Page

Following up on my previous post (”The Bomb Heard ‘Round The World“), in which I proposed no solution, a rather insane idea occurred to me last night that I will now share with you.

First Premise: The generous giving of private individuals in the aftermath of a crisis is truly astounding, and often surpasses even the most optimistic of expectations. For example, when the Indian Ocean earthquake and resultant tsunami struck just after Christmas 2004, an amazing outpouring of relief funds quickly accumulated to the tune of approximately $10 Billion in actual dollars, which does not include such volunteer efforts as those of the United States military and various relief organizations. Private individuals accounted for approximately $3 Billion (as far as I can tell; the total numbers are difficult to come by). Americans alone accounted for over $400 Million in private donations (reaching almost $1.9 Billion by December 23, 2005). When Hurricaines Katrina and Rita struck the Gulf Coast, private donations soared into the $3.5 Billion range by February 20, 2006. (more…)

Sphere: Related Content

What Inquiring Minds Want to Know

Lance on Aug 21 2006 | Filed under: Culture, Domestic Politics, Economics, Foreign affairs, Investing, Lance's Page, Religion and theology, Uncategorized

Tyler Cowen over at Marginal Revolution had a reader ask him which philosophers he would recommend she should read. The discussion was interesting; I decided a good starting point would be Hayek, Popper, Quine and Hume. I also suggested Plato along with Aristotle’s Ethics, Merleau Ponty to cover the phenomenologist’s, skip Bertrand Russell except for fun, maybe some Kant. Wittgenstein if you have time.