Animated Unemployment

Lance on Nov 23 2009 | Filed under: Economics, Lance's Page

A very cool animated Graphic showing the change in unemployment over the last two years.

Click Image for Animation

Lance on Nov 23 2009 | Filed under: Economics, Lance's Page

A very cool animated Graphic showing the change in unemployment over the last two years.

Click Image for Animation

Lance on Nov 08 2009 | Filed under: Economics, Investing, Lance's Page, Uncategorized

Employment as measured by the “establishment survey,” was down by 190,000; and Many feel it is an improvement that we are not falling as fast.

Well, let us take a moment to look under the hood of these numbers. First, while the establishment survey was down 190k, the number of unemployed soared by 558,000, to 15.7 million, as measured by the household survey. The establishment survey is taken from large businesses while the household survey calls individual households. It is the household survey that sets the unemployment rate. The establishment survey of companies doesn’t count the self-employed and undercounts employees of small businesses. So the economic picture is probably worse than the headlines when it comes to jobs.

Lance on Nov 08 2009 | Filed under: Domestic Politics, Economics, Lance's Page

Good Friend Bruce McQuain picks up on a story I noticed yesterday. Rather than rehash it, I’ll let him lay it out:

Sphere: Related ContentGreg Mankiw reminds us of this bit of fantasy:

What we are not doing — what I have no interest in doing — is running GM. GM will be run by a private board of directors and management team with a track record in American manufacturing that reflects a commitment to innovation and quality. They — and not the government — will call the shots and make the decisions about how to turn this company around. – President Barack Obama

And this bit of reality:

Federal support for companies such as GM, Chrysler Group LLC and Bank of America Corp. has come with baggage: Companies in hock to Washington now have the equivalent of 535 new board members — 100 U.S. senators and 435 House members.

Since the financial crisis broke, Congress has been acting like the board of USA Inc., invoking the infusion of taxpayer money to get banks to modify loans to constituents and to give more help to those in danger of foreclosure. Members have berated CEOs for their business practices and pushed for caps on executive pay. They have also pushed GM and Chrysler to reverse core decisions designed to cut costs, such as closing facilities and shuttering dealerships.

Synova on Sep 28 2009 | Filed under: Blogs, Domestic Politics, Economics, Libertarianism, Synova's Page, social science

The Saddest Lede on the Internet Today.

Says Ric Locke on his new blog. And what was the lede? “Americans believe that the normal state of things is not-violence.”

Do you suppose that’s true? That that’s why we have such absurdities as people climbing in zoo cages to cuddle the animals? It would explain a lot of things.

The blog article he links goes on to make some sort of argument that the normal state of capitalism is violence and that people should think about why we put up with it…. or something like that.

It’s shocking to me, even though I’m used to the notion, that people do not realize that violence and war are the normal state of things and that civilization is what we impose upon the natural state. (And yes, there are people who seem not to realize that the cuddly animals really will not act all loving and peaceful because they have an uncorrupted ability to tell that you don’t mean harm.)

I think that sometimes libertarians are too convinced that they aren’t talking about imposing order and miss the truth of it, (or at least those opposed to libertarian ideas are convinced that libertarians oppose the imposing of order.) That’s not the difference between libertarian ideas and those ideologies that consider themselves more caring. The difference with libertarian ideas and with capitalism is that those things work as much as possible with the reality of human nature while recognizing what human nature is. Which is violent… just like the rest of nature is violent and unforgiving.

Viewing capitalism as the source of unfairness, vice and violence ignores the truth. Failing to understand the truth of nature and human nature, to face it squarely, means that the proposed cure for social ills will invariably make them far worse. As Ric says:

It would explain, for instance, why the writer of that article is able to regurgitate a century and a half of Socialist propaganda and get commenters calling it “insightful”. Two centuries of modern capitalism have resulted in such ease, such comfort, such near-total safety and security, that Americans (at least, some Americans) don’t just take it for granted but consider it the normal state of affairs, so much so that they are ready and willing to smash the structures that created it, in the confident “knowledge” that the safety and prosperity will remain because they are “normal”.

He’s a smart guy. Check out his blog.

Sphere: Related ContentSynova on Sep 19 2009 | Filed under: Domestic Politics, Economics, Gov't Spending, Health Care, Race, Synova's Page, Uncategorized

Finally someone said what I’ve been thinking about this constant call to civility:

Have we transformed into so brittle a citizenry that we are unable to handle a raucous debate over the future of the country? If things were quiet, subdued and “civil” in America today, as Pelosi surely wishes, it would only be proof that democracy wasn’t working. (Please read the whole article.)

Sure, Pelosi wishes that everyone would behave already, but it is also often conservatives and others arguing over the proper way of dissenting rather than just dissenting already. There seems to be a practical meltdown in areas of the conservative blogosphere over comportment… the theory seeming to be that passion is off-putting to the all-important center. In order to win, therefore, we need to be bland.

Frankly, I think that other than those in power who would rather not be bothered by opposition, it’s only people without ideas who are arguing over civility.

Sphere: Related ContentKeith_Indy on Sep 01 2009 | Filed under: Domestic Politics, Economics, Keith's Page

This just has me speechless… (or wordless…)

Under the agreement, London-based Diageo PLC will receive tax credits and other benefits worth $2.7 billion over 30 years, including the entire $165-million cost of building a state-of-the-art distillery on the island of St. Croix in the Virgin Islands, a U.S. territory.

…

“The U.S. taxpayer is basically being asked to line the pockets of the world’s largest liquor producer,” says Steve Ellis, the president of Taxpayers for Common Sense, a nonpartisan watchdog organization.

Some of the points Ed Morrissy is pointing out, which is the reason for my not thinking straight…

I think if this is what passes for “smart leadership” in Washington, I’ll take the status-quo for $1000, Alex.

Go read the whole thing for updates.

Sphere: Related ContentChrisB on Apr 13 2009 | Filed under: Chris' Page, Domestic Politics, Economics, taxes

Today is the day that we have earned enough to pay its tax burden for the year. This year’s day comes earlier than last year, though this is due to recent stimulus effects. Before you start to celebrate though, Doug Bandow warns us that the future does not look good on the tax burden front.

Runaway spending ensures that this year’s TFD will be dwarfed by future TFDs. Some day someone will have to pay off the debts being run up today. The Obama administration’s budget figures are bad enough, but they almost certainly rest upon unrealistic economic expectations. The CBO again offers a sobering analysis: “CBO’s estimates of deficits under the President’s budget exceed those anticipated by the administration by $2.3 trillion over the 2010-2019 period.”

What do do about it? Many are taking to Tea Party protests. While Jon Henke defends the protests from Paul Krugman’s libel.

Yet, in today’s New York Times column (in which he makes some reasonable points about the sad state of the Republican Party), Paul Krugman grossly misuses a term to libel a variety of people.

Last but not least: it turns out that the tea parties don’t represent a spontaneous outpouring of public sentiment. They’re AstroTurf (fake grass roots) events, manufactured by the usual suspects. In particular, a key role is being played by FreedomWorks, an organization run by Richard Armey, the former House majority leader, and supported by the usual group of right-wing billionaires. And the parties are, of course, being promoted heavily by Fox News.

What Freedomworks and various other organizations are doing is not “astroturf” any more than the anti-war protests of some years back were astroturf because ANSWER and Moveon.org helped organize people around those events. Astroturfing is paid activism by an organization; it is not genuine grassroots activism that funded groups are simply helping to organize.

Update: More piling on from my home town Tea Party site.

Sphere: Related ContentKeith_Indy on Apr 10 2009 | Filed under: Domestic Politics, Economics, Keith's Page

Over at Instapundit, Glenn has been keeping an eye on both the Tax Day Tea Party and the New Way Forward demonstrations.

Reading about what the left is doing, I have to think, that if the left thinks banks that are “to big to fail” should be broken up, then what about government programs like social security, medicare, and medicaid?

Surely, these are just as big, and they are to important to fail. Shouldn’t these also be broken up??

And once they’re done with the banks, and the auto industry, what are they going to find “to big to fail” then???

Sphere: Related ContentChrisB on Mar 25 2009 | Filed under: Chris' Page, Domestic Politics, Economics, taxes

Via Greg Mankiw comes this letter by a Mr. Desantis published in the NYTimes. The government is spinelessly trying to punish the very people who’s help it most needs. It’s almost tragic really.

I am proud of everything I have done for the commodity and equity divisions of A.I.G.-F.P. I was in no way involved in — or responsible for — the credit default swap transactions that have hamstrung A.I.G. Nor were more than a handful of the 400 current employees of A.I.G.-F.P. Most of those responsible have left the company and have conspicuously escaped the public outrage.

After 12 months of hard work dismantling the company — during which A.I.G. reassured us many times we would be rewarded in March 2009 — we in the financial products unit have been betrayed by A.I.G. and are being unfairly persecuted by elected officials. In response to this, I will now leave the company and donate my entire post-tax retention payment to those suffering from the global economic downturn. My intent is to keep none of the money myself.

And I think I find Andrew Cuomo’s actions the most deplorable. The head of the law and order of the state of New York, residing in an office dedicated to due process and innocent until proven guilty, used his powers and office to threaten and intimidate these people’s privacy and it’s not really a stretch to imagine, their very lives. Cuomo should resign in shame immediately for such a gross misuse of his office, but instead he will be thrust on people’s shoulders as a hero. A sign of the times, to be sure.

Sphere: Related ContentChrisB on Mar 02 2009 | Filed under: Chris' Page, Domestic Politics, Economics, Libertarianism

I didn’t get to make it out, as I work almost 30 miles away, but here’s the video:

Keith_Indy on Feb 27 2009 | Filed under: Domestic Politics, Economics, Keith's Page

Come one, come all. Anyone interested in attending a mass rally protesting the mess our government is, come join Hoosiers for Fair Taxation on March 25th at the capital building in Indianapolis.

They are also calling for volunteers, and there are sponsorship opportunities for anyone willing to donate money.

Keep an eye on their blog to stay informed about this.

Hoosiers for Fair Taxation were ahead of the times 2 years ago, as they held a Tea Party to protest the property tax increases that occurred in Indiana at that time.

Sphere: Related ContentChrisB on Feb 19 2009 | Filed under: Chris' Page, Domestic Politics, Economics, Investing, housing, regulation, taxes

Rick Santelli just went off on Obama’s housing proposal live on CNBC from the commodities trading floor in Chicago.

It’s now the headline on Drudge:

VIDEO: ‘The government is promoting bad behavior… do we really want to subsidize the losers’ mortgages… This is America! How many of you people want to pay for your neighbor’s mortgage? President Obama are you listening? How about we all stop paying our mortgage! It’s a moral hazard’… MORE…

TRADERS REVOLT: CNBC HOST CALLS FOR NEW ‘TEA PARTY’; CHICAGO FLOOR MOCKS OBAMA PLAN

Who is John Galt?

Sphere: Related ContentKeith_Indy on Feb 13 2009 | Filed under: Domestic Politics, Economics, Keith's Page

Glenn Reynolds ponders “IS IT PITCHFORK TIME? Dang, I don’t own a pitchfork. Oh well, they’re not too expensive. Maybe mail a bunch to Congress, first . . .”

I think shovels would be a more appropriate gift to send to our Congressmen. They must be standing knee deep in cow manure to believe their doing what’s best for the nations economy. And it would also give them a head start on their “shovel ready” projects.

Sphere: Related ContentKeith_Indy on Feb 13 2009 | Filed under: Domestic Politics, Economics, Keith's Page

Well, the final text of the spendathon bill is out, looks like it was a late night in the halls of Congress.

Interesting that they chose not to create a searchable PDF, but scanned in a printed version, with markups.

hr1_legtext_cr.pdf – Created 2/12/2009 11:44:51 PM Modified 2/13/2009 12:40:12 AM

hr1_legtext_crb.pdf – Created 2/12/2009 11:55:17 PM Modified 2/13/2009 1:19:36 AM

hr1_cr_jse.pdf – Created 2/12/2009 10:22:08 PM Modified 2/13/2009 1:02:34 AM

hr1_cr_jseb.pdf – Created 2/12/2009 10:22:44 PM Modified 2/13/2009 1:26:21 AM

So much for promises of transparency by the Obama administration.

So much for the post-partisan Presidency.

Sphere: Related ContentChrisB on Feb 05 2009 | Filed under: Chris' Page, Economics, Humor

Keith_Indy on Jan 06 2009 | Filed under: Domestic Politics, Economics, Keith's Page

The current bailout mania, and the long going practice of spending our way into debt, ought to be considered the highest form of “taxation without representation” as the government is taxing the future revenue of people who, at the moment, can not vote, may not even be born, or who currently are not US citizens.

The injustice of it all!!!

Sphere: Related ContentChrisB on Dec 11 2008 | Filed under: Chris' Page, Domestic Politics, Economics

Greg Mankiw has a post today look at the real world studies of spending and tax multipliers. Keynesians might be surprised to learn that the tax multiplier appears to be much larger than the spending one. Studies put the Government spending multiplier at or around 1-1.4 while other studies have the tax cut multiplier at or around 3. This means that for ever dollar cut in taxes, we get a 3 dollar increase in GDP.

He ends with some good advise to President Elect Obama:

My advice to Team Obama: Do not be intellectually bound by the textbook Keynesian model. Be prepared to recognize that the world is vastly more complicated than the one we describe in ec 10. In particular, empirical studies that do not impose the restrictions of Keynesian theory suggest that you might get more bang for the buck with tax cuts than spending hikes.

I have a feeling we’re definitely going to see a spending increase though, so I’m not sure whether to hope for a tax cut or not.

Sphere: Related ContentLance on Dec 03 2008 | Filed under: Domestic Politics, Economics, Humor, Lance's Page

I hear repeatedly from our fellow citizens “where is my bailout?” For those who have been wondering the fine journalists at Vanity Fair have found the paperwork so you can begin applying now for, as the application says, “free government cash.” (Click image for Large Version.)

Sphere: Related ContentLance on Dec 02 2008 | Filed under: Domestic Politics, Economics, Humor, Lance's Page

By Fred Thompson. With only the most minor quibbles I not only laughed, but cried. Pretty much dead on:

The sad thing is that it isn’t only “liberal” economists, it is the meat of the profession and plenty of so called “conservative” politicians.

Hat Tip: McQ

Sphere: Related ContentLance on Dec 02 2008 | Filed under: Economics, Lance's Page

Now that the NBER has decided to endorse my view that we went into recession last December which I first first claimed last January, I think my points about the efficacy of fiscal stimulus still apply.

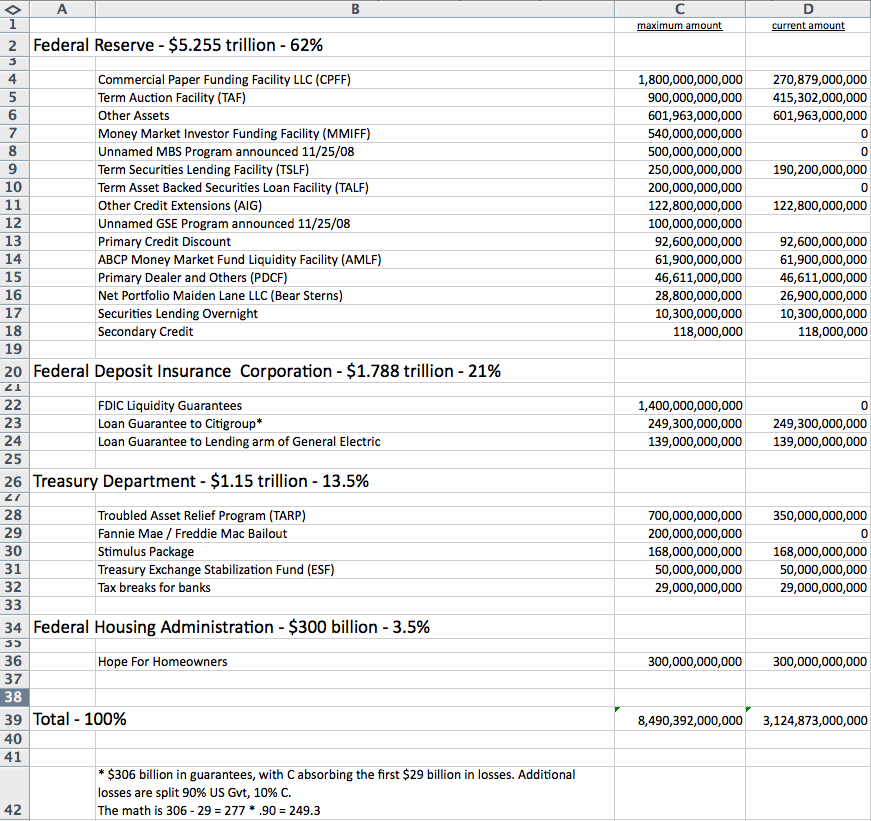

As for spending already pledged to save us, the figures are growing at a rate that has even astounded someone as bearish and cynical as myself. Barry Ritholtz has given us a breakdown and a spreadsheet to track it:

I suspect given the continuing issues and a President intent on expanding the government balance sheet even more than our present one that that spreadsheet will get quite a bit larger. All that money to save a $13 trillion economy. What a mess.

Meanwhile the housing market continues to collapse, as the lights repeatedly seen at the end of a tunnel seem to really just be a series of oncoming trains. Lots of charts and analysis here and here.

Sphere: Related ContentLee on Nov 20 2008 | Filed under: Economics

Italian economist Loretta Napoleoni (of Rogue Economics fame), blames the lingering financial crisis in part on the American War on Terrorism, which inaugurated an allegedly “suspicious attitude…toward Muslim investors.” She goes further though, and argues that the only solution to the turmoil lies in embracing the financial rules mandated by the doctrines of medieval Islamic Sharia:

Islamic finance is a system based in shariah law. Central principals include a prohibition against charging interest and a code of ethics for investments – for example, barring investments in prostitution. Napoleoni said these principals are actually quite similar to the principles of classical economics.

“A bank should be a profit organization, but the moment in which the social role is forgotten and the profit role takes over, then a bank is actually working against the people who are putting their money into the bank, the clients. Now that, of course, in Islamic finance could not happen, because there is this partnership between the client and the banks. There is a social commitment within finance which we had before, but we lost it.”

(UNM)

Makes sense. When you’re looking for lessons in the administration of an advanced, adaptive, and sophisticated modern financial system, clearly we have a lot to learn from economic titans like Yemen. Lately financial sharia in that country has produced a permanently premodern economy with 40 times the population of Vermont, subsisting on about 80% of Vermont’s annual GSP. Sounds like a good deal to me.

(more…)

Sphere: Related ContentLance on Nov 17 2008 | Filed under: Economics, Investing, Lance's Page

The insufferable Peter Schiff has a video going around, which frankly, is just brilliant. He may be unpleasant at times, but he nailed this thing, and took mounds of abuse while doing so. More importantly, I KNOW HOW HE FEELS!

The resentment, irritation, condescension and, at times, outright hostility to my Cassandra act makes me wish I had a video of my own. Sigh…

Oh well, it pays to remember that Cassandra was right. I was never as sure of myself as Peter, but risk management isn’t about knowing you are right, but knowing what could go wrong and whether it is likely enough to act upon.

As an aside, Peter is no big government type, and he goes to prove that despite the media focusing on Roubini and others (who do deserve a lot of credit) that people across the ideological perspective warned of this. Thus having seen this coming is not the same as being correct about what to do about it, since those who saw the oncoming train differ markedly on that score.

Sphere: Related ContentLance on Nov 16 2008 | Filed under: Economics, Lance's Page

Given the topic of tonight’s podcast I thought a little visual data might help. First, the explosion in US debt:

Henry Blodget explains:

From the early 1920s through 1985, the average level of debt-to-GDP in this country was 155%. The highest peak in history (until the recent debt boom) was in the early 1930s, when debt-to-GDP soared to 260% of GDP. In the 1930s, the ratio then cratered to 130%, and it remained close to that level for another half century. (See chart below).

In 1985, we started to borrow, and last year, when we got finished borrowing, we had borrowed 350% of GDP. To get back to that 155%, we need to get rid of more than $25 trillion of debt.

Do we have to get back to 155% debt-to-GDP? No, we don’t have to. But given what happened after the 1920s, and given what people will probably think about debt when they get through getting hammered this time around, we wouldn’t be surprised if we got back there. It seems to be sort of a natural level.

The banks have written off $650 billion so far. So we suppose that’s a start.

That would mean reducing (de-leveraging) our economy’s debt load by 25 trillion. I have no idea how you cut even 10 trillion in debt without massive economic dislocation.

Sphere: Related ContentLee on Nov 06 2008 | Filed under: Economics

The winners of the global financial turmoil look to be three American ’superbanks’: JP Morgan Chase, Bank of America and Wells Fargo. The institutions have all grown to occupy such a predominant position in the marketplace, that all three recently surpassed the Federal cap intended to prevent any one institution from controlling more than 10% of domestic deposits. A staggering realization of their scale.

(more…)

Sphere: Related ContentLee on Nov 05 2008 | Filed under: Economics, Foreign affairs

South Korea is getting jittery about prospects for its long sought Free Trade Agreement with the United States, which is still yet to be approved by both countries, and is now under threat from a potentially protectionist Obama administration.

In the past Obama has criticized the agreement as deeply flawed, but has proven somewhat idiosyncratic about that at other times. South Korean Trade Minister Kim Jong-hoon must not like the trend of things though, as today he took the remarkable step of categorically ruling out any renegotiation of the agreement to placate the incoming administration, despite renegotiation talks being something Obama has insisted on.

(more…)

Sphere: Related ContentLee on Nov 01 2008 | Filed under: Economics, Foreign affairs

So, did you enjoy the much discussed post-American world order? Hope you didn’t miss it. Surely it didn’t lack for advertising.

But if you did happen to step out for a moment, we just lived through the end of market capitalism, the death of the dollar, the collapse of American power, the cultural and political atrophy of the West, the rise of Eastern dictatorships to world leadership, and petrocracy as the vanguard political philosophy of the future.

Bill Emmott notices that a lot of this isn’t exactly plausible in historical context, and that with the collapse in the price of oil, a strengthening dollar, an even worse European recession and the unavailability of predicted competitive alternatives to American power…the post-post-American moment may be upon us.

(HT:

Sphere: Related ContentSynova on Oct 30 2008 | Filed under: Domestic Politics, Economics, Hugo Chavez, Libertarianism, Synova's Page

The idea of “Going John Galt” makes me a little bit uncomfortable, to tell the truth. John Galt essentially said screw them all, and shut down knowing that a whole lot of people would be hurt. It was about the only way he could make his point and make it stick.

Maybe we could do this without shutting down the economy?

But, as I think about it, a protest citing John Galt and out and out telling people what is going on might be a good idea, because people are going to go John Galt… quietly.

And I have no faith at all that anyone who now thinks that it’s a good thing to make the rich pay are going to understand what happened any more than Chavez or Mugabe understand what happened (or is happening) to their economies.

Sphere: Related ContentChrisB on Oct 21 2008 | Filed under: Chris' Page, Domestic Politics, Economics, Election 2008, taxes

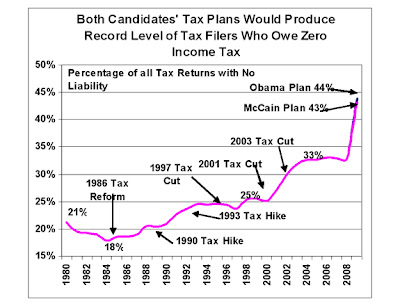

Under McCain and Obama's tax plans 43% and 44% would pay no income tax respectively

Fewer and fewer people are paying income tax and even less will be with either candidates tax plan. I don’t think this would be such a problem if we didn’t have such high spending, growing entitlements, and if so many of these zero income tax filers weren’t getting additional handouts from the government (especially under Obama’s tax “cuts” ie. handouts).

It has been said by an unknown author “[Democracy] can only exist until the voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury…” and this is where we’ve been heading for awhile. I think just as a tax plan can be too regressive, it can be too progressive in that it places too high a burden on “the rich” resulting in them leaving (atlas shrugs) or seeking tax shelters, and at the same time having too much of the population with no civic tax obligation leaving them no incentive to constrain public spending (hey, it’s not their money right?)

(HT Greg Mankiw)

Sphere: Related ContentLance on Oct 20 2008 | Filed under: Economics, Lance's Page, social science

Does the object of our desire tend to change during tough times?

Yes, according to this paper on men’s preferences when it comes to Playboy’s models:

Consistent with Environmental Security Hypothesis predictions, when social and economic conditions were difficult, older, heavier, taller Playboy Playmates of the Year with larger waists, smaller eyes, larger waist-to-hip ratios, smaller bust-to-waist ratios, and smaller body mass index values were selected. These results suggest that environmental security may influence perceptions and preferences for women with certain body and facial features.

For those wishing to do their own analysis you can download the data here. Tyler Cowen notes that the hypothesis is not fully supported by 2008’s selection.

Sphere: Related ContentLance on Oct 17 2008 | Filed under: Economics, Humor, Lance's Page

Lance on Oct 14 2008 | Filed under: Economics, Investing, Lance's Page

I wonder if the juxtaposition of that headline and that photo was intentional?

Anyway, over at Risk and Return I follow up Dale, McQ and my discussion of the markets and the economy during the last couple of podcasts with some thoughts, observations and suggested readings on the investment climate we are in now. Lots of links, some enlightening graphics and views from those who saw this coming, including, ahem, me.

There are hopeful signs, but large risks. How cheap are stocks? What are the risks that remain? Will recent government moves help?

My own view is that some of it will, though it is not ideal, but possibly close enough for government work.

Let me know what you think in the comments here or via e-mail.

Sphere: Related ContentLance on Oct 12 2008 | Filed under: Economics, Lance's Page

Yves Smith hits a theme I have been harping on, the Federal Reserve, and central banks in general, are making things worse in may ways by destroying the incentive for banks to lend or borrow from one another. She quotes James Bianco of Arbor Research:

The Fed’s massive and numerous liquidity facilities are making things worse. The problem is more than banks unwilling to lend to each other, they are also unwilling to borrow from each other. Banks can get all the funding they need (and then some) from their central bank so they do not need to seek a loan from another bank. I believe it has gotten so bad that they don’t even bother to make a decent market for inter-bank loans anymore. No reason to, they don’t need them anymore as central banks have replaced them.

I would suggest more subtle factors should also be emphasized besides how this distorts rates on loans. If banks do not need each other then they don’t communicate. Thus the hard work of investigating what counterparties real credit risk is goes undone. The market is shunting that off to governments. Furthermore, banks have no incentive to arrive at a believable accounting of their assets, they can wait and hope for a bailout rather than find a way or terms that other banks will accept.

Sphere: Related ContentLance on Oct 10 2008 | Filed under: Economics, Foreign affairs, Investing, Lance's Page

The Markets have spoken, the best place to invest in the world is…Iraq!

Sphere: Related ContentNow it’s stock and awe in Baghdad!

As the Dow plummeted nearly 700 points yesterday to fall well below the 9,000 mark, the Iraqi stock exchange – where this broker was merrily keeping up with her booming business – was flourishing, buoyed by four-year lows in violence and hopes of a reconstruction windfall.

Last month, Iraq’s general index went up nearly 40 percent, about the same percentage the Dow dropped over the past year. The jovial trading-floor mood is reminiscent of Wall Street’s bygone ‘greed is good’ era of the 1980s.

ChrisB on Oct 07 2008 | Filed under: Chris' Page, Domestic Politics, Economics, Libertarianism

says two UCLA economists.

Two UCLA economists say they have figured out why the Great Depression dragged on for almost 15 years, and they blame a suspect previously thought to be beyond reproach: President Franklin D. Roosevelt.

After scrutinizing Roosevelt’s record for four years, Harold L. Cole and Lee E. Ohanian conclude in a new study that New Deal policies signed into law 71 years ago thwarted economic recovery for seven long years.

“Why the Great Depression lasted so long has always been a great mystery, and because we never really knew the reason, we have always worried whether we would have another 10- to 15-year economic slump,” said Ohanian, vice chair of UCLA’s Department of Economics. “We found that a relapse isn’t likely unless lawmakers gum up a recovery with ill-conceived stimulus policies.”

In an article in the August issue of the Journal of Political Economy, Ohanian and Cole blame specific anti-competition and pro-labor measures that Roosevelt promoted and signed into law June 16, 1933.

Not exactly news to free market liberals, but still something very important to remember in these comming days of cries for the government to “do something” and distrust of the free market.

Sphere: Related ContentLance on Oct 02 2008 | Filed under: Economics, Lance's Page

I have argued in the past that the Federal Reserve’s policies may be helping in some ways, but hurting in others. Way too much borrowing and lending is running through the Fed which is drying up lending between banks. It also reduces the need for banks to find reasons to communicate and trust each other, keeping the atmosphere of mistrust alive.

On a similar note one of Yves Smiths commenters left this comment, which is well worth pondering when thinking of the bailout plan being considered:

Sphere: Related ContentOne of the most critical functions of the banking system is converting short-term deposits into longer-term loans for businesses. Much of the working capital market, for decades has come via money market funds (MM). Joe public or Joe CFO deposits money into a MM. That MM loans it to a bank (usually by buying paper, and usually at a medium duration) and then that bank loans it out to business for inventory, payroll or whatever. The MM has converted Joe’s demand deposit into a fixed-duration loan.

The problem we’re having is that people are fleeing commercial MM for treasury MM. Those are buying treasuries and thus converting the money to the desirable medium duration BUT that money is loaned to the Fed, and the Fed doesn’t make working capital loans. So the deposited money that had been made into working capital has been diverted into the Fed and lost to working capital.

The Fed is kind of trying to address this by loaning out money via various auction/discount windows. BUT, those loans have been overwhelmingly overnight – a particularly nasty demand deposit because it goes back so fast. For a bank to convert that to a 90-day loan it’s got to win 90 auctions in a row – a very risky deal with a crunch on. So the Fed undoes the duration conversion, and then some, converting the liquidity into a form that the banks can’t make into useful-duration loans.

Right now we have both commercial and treasury MMs. Deposits have shifted from commercial MMs to treasury MMs, and consequently we have less working capital (a commercial MM product) and better credit for the Fed (a treasury MM product). But, treasury MM rates are now very low and the gap between treasury and commercial fairly high, which creates an incentive for depositors to put money into commercial funds, producing some working capital.

When Paulson dumps out his 700 billion in treasuries it’s going to be at the short end. That will drive up rates for short-term treasuries. This will obviously draw even *more* deposits into the treasury MMs. That means even less in the commercial MMs and thus less working credit, the eventual commercial MM product. Hence Paulson’s billions remove working capital by competing for the deposits that could get used to make working capital loans. That 700 billion is going to go to fairly long-term mortgage securities. So Paulson’s billions divert credit from working capital to long-term mortgages – from where it’s most needed to where it’s most wasted.

Even if the giveaway adequately props up the banks, which I doubt, they still can’t make working capital loans, because the raw material they used (commercial MM deposits) will be desperately short.

I think it’s very telling that in two days of hearings and two weeks of discussion we have yet to see *any* detailed mechanism for how Paulson’s plan will increase the supply of, say, inventory loans. It’s not that every economist in the world is an idiot, it’s just not going to help. I think people have fallen into the fallacy that if it costs a lot it must be valuable. Paulson’s plan falls into the category of very expensive way to hurt ourselves.

Lance on Oct 02 2008 | Filed under: Domestic Politics, Economics, Lance's Page, regulation

Tyler Cowen states his basic views on the crisis. My response in italics:

(more…)

Lance on Oct 02 2008 | Filed under: Economics, Humor, Investing, Lance's Page

A new distressed debt leveraged hedge fund has been launched:

Go visit the website for all their competitive advantages!

Lance on Oct 01 2008 | Filed under: Domestic Politics, Economics, Lance's Page

Let us look at one of the ways that we are being panicked unnecessarily, and why incidentally we can help many of these financial institutions in the fashion I discussed in my post on a potential alternative plan. In my next post we will discuss ways in which we are not being misled, and why we in my mind should do something about this.

(more…)

Lance on Oct 01 2008 | Filed under: Domestic Politics, Economics, Lance's Page

I do believe we should be doing something as a nation, through our government, to avoid the not insignificant chance of a total financial meltdown. I have seen several things proposed that I find interesting, and I will get into them and other longer term issues in coming days. I had hoped to address this all comprehensively, but time just isn’t allowing that, so let us do so piecemeal.

Today I would like to endorse one proposal that aligns exactly with my thoughts on this, which is we need to recapitalize banks in a more effective, less arbitrary manner while protecting taxpayers and homeowners as well.

(more…)

Lance on Oct 01 2008 | Filed under: Domestic Politics, Economics, Lance's Page, taxes

If you support the Paulson bailout plan that is. The New York Times has coverage.

The Senate proposal would cost more than $100 billion and extend and expand many individual and business tax breaks, including tax credits for the production and use of renewable energy sources, like solar energy and wind power.

The bill would also extend the business tax credit for research and development, expand the child tax credit, protect millions of families from the alternative minimum tax and provide tax relief to victims of recent floods, tornadoes and severe storms.

In a delicious bit of soon to be civics geek trivia, the Senate worked around the Constitutional restrictions against voting on tax legislation not already considered by the House by attaching the bailout plan along with a tax extender bill to the Mental Health & Addiction Act (which passed the House several months ago).

You gotta love our government.

In addition to the Paulson plan details, various tax cuts and dealing with the AMT it includes a very helpful proposal, increasing government insurance on bank deposits from 100k to 250k.

Sphere: Related ContentLance on Sep 30 2008 | Filed under: Economics, Lance's Page

The Federal Reserve has for a long time eschewed increasing the money supply directly, and instead has manipulated credit to affect the economy and control inflation. This has led to three important things which are in my opinion at the root of this crisis.

The last fascinates me, as a sector which should be a relatively small part of the economy functioning as intermediaries has through leverage achieved profits (a redistribution of wealth from the rest of our citizenry) far from the size their intermediary function can possibly justify. These intermediaries for example accounted for about a third of the market capitalization of the S&P 500 before they crashed and burned. How do the intermediaries deserve a market cap that amounts to around half of those for whom they intermediate?

The answer is increased leverage. I’ll address this in more detail later, but the Federal Reserve has finally decided to expand the monetary base, which has consistently grown at a very slow, or non existent rate. From David Merkel:

Check out the very far left side of the graph and look at the vertical takeoff.

David fills us in on the details:

Look at the H.4.1 report. We may have finally hit the panic phase of monetary policy, where the Fed increases the monetary base dramatically. They are pumping the “high-powered” money into loans:

- $20 billion for Primary credit

- $80 billion for Primary dealer and other broker-dealer credit

- $70 billion for Asset-backed commercial paper money market mutual fund liquidity facility

- $40 billion for Other credit extensions

- $80 billion for Other Federal Reserve assets

- -$20 billion netting out other entries

Making it an increase of roughly $270 billion from last week’s average to Wednesday’s daily balance. Astounding.

In general, the increases are not being pumped into the banks, but into specialized programs to add liquidity to the lending markets. Now, I’ve written about this before, but it bears repeating. What happens if the Fed takes losses on lending programs. It reduces the seniorage profits that they pay to the Treasury, which means the Treasury has to tax or borrow that much more. The Fed isn’t magic; it’s a quasi-extension of the US Government in a fiat currency environment. It’s balance sheet is tied to the US Treasury.

Yves Smith at Naked Capitalism is correct. The US is no longer a AAA credit, particularly if you measure in terms of future purchasing power of US dollars. I’ve felt that for years, though, with all of the unfunded future promises that the US Government has made with Medicare, Social Security, etc. The credit of the US Government hinges on foreign creditors (like OPEC and China) to keep it going. What will they offer them? The national parks?

True, all true, but possibly if they are going to provide monetary stimulus this might be a better way than cutting rates, now and in the future.

Sphere: Related ContentLance on Sep 29 2008 | Filed under: Domestic Politics, Economics, Lance's Page

I was not in favor of the Paulson plan if you haven’t caught that yet. Still, the pitiful display from our congress today set a recent low.

First, faced with an unpopular and contentious bill which she feels for the good of the nation must be passed, we get a partisan and divisive speech from Nancy Pelosi:

Pelosi had said that the $700 billion price tag of the measure “is a number that is staggering, but tells us only the costs of the Bush Administration’s failed economic policies — policies built on budgetary recklessness, on an anything goes mentality, with no regulation, no supervision, and no discipline in the system.”

Pure horse hockey. More importantly, if Pelosi believes her rhetoric about the importance of this bill the poor judgment, lack of leadership and inability to understand the importance of statesmanship in a crisis should be grounds for immediate dismissal from her post.

Then, we get this pathetic response from the Republican leadership:

“I do believe that we could have gotten there today had it not been for this partisan speech that the speaker gave on the floor of the House,” House Minority Leader John Boehner (R-Ohio) said, adding that Pelosi “poisoned” the GOP conference.

Deputy Minority Whip Eric Cantor (R-Va.) held up a copy of Pelosi’s floor speech at a press conference and said she had “failed to listen and to lead” on the issue.

The Speaker had blasted the Bush administration in her speech and Minority Whip Roy Blunt (R-Mo.) asserted that some GOP lawmakers, who had reluctantly agreed to support the bill, might have changed their minds following Pelosi’s remarks.

“Might” have effected them? What whining. If it is false it shows the same tin ear that Pelosi demonstrated. If it is true it is even worse. Either way, did it not occur to them how petty it would look in a moment of crisis?

If these congressman or women really didn’t support the bill and were going to vote for it anyway, the idea that they would change their votes because Pelosi was her normal clueless self is enough to deprive them of my vote forever. It is even more damning if they thought the bill was necessary and voted against it due to her behavior.

This is a disgrace.

Sphere: Related ContentChrisB on Sep 29 2008 | Filed under: Chris' Page, Domestic Politics, Economics

doesn’t look like it’s going to pass the House floor.

Update: It failed.

The vote was 207-226 against the measure, with one member not voting, half an hour after voting began. Voting remains open even though the “official” time has expired for casting a ballot.

There was broad bipartisan opposition to the measure, with 95 Democrats and 133 Republicans voting against the bill. Republicans voted more than 2-1 to oppose the bill.

Update 2x: The gavel hasn’t fallen yet and already 2 people have changed their vote to ‘yes’, possibly feeling pressure from the large losses in the DOW after the rejection. Supposedly the Dems are trying to get 4-10 R’s to switch their vote to ‘yes’ and then a huge number of Dem’s will change theirs to ‘yes’ as well. Similar to the strategy that the GOP had with NAFTA in the 90s of getting a good number of Democrats to vote for it to cover themselves politically against any populist blowback.

Sphere: Related ContentLance on Sep 29 2008 | Filed under: Economics, Lance's Page

Larry Summers and Mark Thoma argue that if done right the bailout will mean we can solve this crisis and still have everything we want, tax cuts, health care spending and all kinds of other goodies. Larry argues:

Just as a family that goes on a $500,000 vacation is $500,000 poorer but a family that buys a $500,000 home is only poorer if it overpays, the impact of the $700bn programme on the fiscal position depends on how it is deployed and how the economy performs. The American experience with financial support programmes is somewhat encouraging. The Chrysler bail-out, President Bill Clinton’s emergency loans to Mexico, and the Depression-era support programmes for housing and financial sectors all ultimately made profits for taxpayers…

Maybe, but Alex Tabarrok finds this optimism a bit ironic:

Does this sound familiar? I can hear it now. A vacation sir is consumption but a home, ah a home, that’s investment. Investments pay off. Just look at the American experience. Rising home prices! Never a downturn. Isn’t that encouraging? Hell, at prices like these you can hardly afford not to buy. Yes sir, a home that’s a wise investment. And that makes you sir, a wise investor. And a wise investor, well a wise investor can certainly afford a nice vacation.

How the economy performs isn’t really the issue as much as the housing market. Chrysler was bailed out at a cyclical low, we are not at a cyclical low in housing, we aren’t even at a cyclical average. We aren’t even close.

Nor was Chrysler such a rousing success anyway. The bailout of Detroit only postponed the pain for the American auto industry and kept them from either going out of business or becoming better, if probably somewhat smaller organizations, and the costs to us all will eventually be pretty damn high. That isn’t even factoring in cementing the idea of “too big to fail” in corporate America. That encourages larger organizations rather than more profitable ones to be created.

Sphere: Related ContentLance on Sep 21 2008 | Filed under: Domestic Politics, Economics, Lance's Page, Law, regulation

Continuing the discussion on tonight’s podcast, one of the recurring themes of much of the commentary on our current financial crisis is that the cause is too much deregulation. Possibly there is some truth to this, though the evidence is rather vague. The most disturbing figure in all this is Barney Frank.

“We need stricter standards on loans.”

Except, the problem here wasn’t lack of regulation, but that the regulations were not enforced, or fraud, by lenders, brokers and their clients. More laws doesn’t help. This was also a failure of long standing, not new. I would suggest simplifying and increased enforcement would be a better option.

(more…)

Lance on Sep 18 2008 | Filed under: Domestic Politics, Economics, Investing, Lance's Page

The hedge fund industry is feeling gloomy, and so is Mayfair.

Meanwhile our government is considering following London’s lead and making their lives even more difficult, by banning short selling for a while. Yep, Fannie would have been just fine with mismatched liabilities, toxic assets and corrupt accounting mixed in with 40-1 leverage if nobody had been selling their stock, which is really all a short sale is.

This is crazy, and likely to lead to a much worse environment for both investing and the smooth functioning of capital markets, which are supposed to over time allocate capital. They are not supposed to lead to higher returns regardless of the worth of a company.

Wealth is not created out of thin air, it is supposed to be connected to the actual income stream a company can produce over time.

Market corrections are what keep wealth from being a product of a mere price we would like for assets, which is awfully disappointing to those who want wealth to be a casino where the house always loses, the drinks are free and the girls (or young men) always accommodating. (more…)

Sphere: Related ContentLance on Sep 17 2008 | Filed under: Economics, Investing, Lance's Page

Today the Fed went to the Treasury and asked for a line of credit. You know, the lender of last resort has had to turn to our Treasury to protect their balance sheet.

Want to see something weird. and look at the treasury market. In the bond world, a 1% move is huge. So check out what has happened in the US Treasury market. Especially the 13 week Treasury bill. It’s yield collapsed by over 97.67% today.

Astounding, truly astounding.

My father who invested (and very successfully) through the late sixties/early seventies nifty fifty era, the bear market of 72-74, the market low in 1981 and Black Monday in 1987 says this is the most incredible market in all of his experience. It certainly eclipses anything I have seen from 1980 forward.

Update: Courtesy of Eddie Elfenbein:

At one point today, the yield on the three-month Treasury bill (^IRX) hit 0.01%!!

One Freakin Bip!!

This means that the risk-free rate is now in direct competition with the underside of your mattress.

Lee on Sep 09 2008 | Filed under: Domestic Politics, Economics, Lee's Page

(photo: Ian Murchison | website)

The nationalization of Fannie & Freddie is often presented as a crisis of faith for the political right, due to its manifest incompatibility with the advertised belief in the “free market.” However, Sunder Katwala at NextLeft cleverly recognizes that it also presents a challenge to orthodoxy on the left, given that the insisted purpose of the nationalization isn’t government ownership, but to rescue businesses for a stable return to the private sector.

(more…)

Sphere: Related ContentMikeR on Sep 07 2008 | Filed under: Around the Web, Economics, MikeR's Page

Redstate

A good description of what just happened to Fannie Mae and Freddie Mac and some reasons why. This made me laugh. “If we were in China, they’d probably have “committed suicide” with bullets inexplicably entering the backs of their heads. I’d certainly want to shoot them if I were a shareholder of either GSE. There are some things the Chinese do better than we do.”

Get rewarded at leading casinos.